Here are some resources that I currently use and love! I am very picky about the tools and resources I promote here, and the ones listed are from companies that I personally use and believe will help you too!

This page may contain affiliate links, which means I get a small commission should you choose to purchase or sign up through one of my links, at no extra cost to you. I only recommend products that I personally use and believe in. You can read more about this in my disclaimer.

Banking: Ally Bank

I personally have all of my checking and savings accounts with Ally. Their online savings is a high-yield savings account with a competitive interest rate, no account fees, and no minimum balance requirements.

The online checking is great as well and makes it easy to transfer money to savings instantly. The only thing you can’t do with an online bank is deposit cash (but who really needs to do that these days?)

They’re FDIC insured and the customer service has been great!

Check out Ally Bank here!

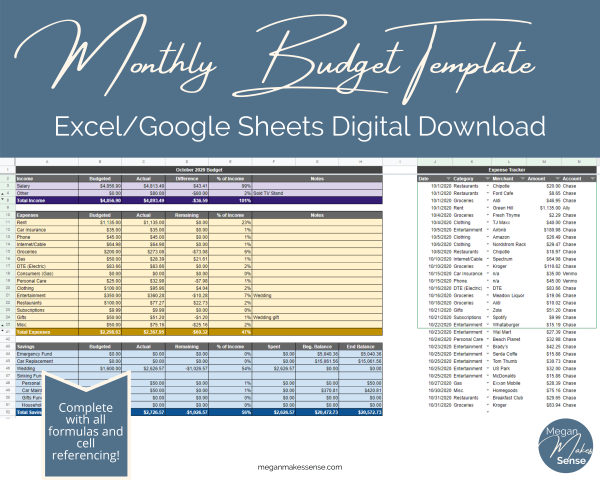

Budgeting: My Spreadsheet Templates

These templates work in any spreadsheet software, have pre-filled budget categories, and a spending tracker included.

I’ve been using these templates for over 3 years now, and they have helped me pay off all of my student loan debt, max out retirement accounts, and see how much of my income goes to each category in my budget.

You don’t need to be great with spreadsheets to use them, and set up instructions are included with every purchase!

Check out my template shop here!

Investing Education: Personal Finance Club Index Fund Investing Course

If you want to build wealth, investing is a MUST.

If you’re ready to start investing and don’t know where to start, this index fund investing course is your one-stop-shop for all things index funds, retirement, wealth-building, how the stock market works, asset allocation, and more!

The creator, Jeremy, retired at age 36 and lives off his index fund investments. He breaks everything down in a super simple manner and even shows you how to buy a stock!

I see other creators charging 10x what Jeremy charges for the same information. He also donate 20% of profits to charity!

Check out the course here!

Overall Personal Finance Education: Personal Finance Club “Money Like a Millionaire” Course

If you’re just getting started with your finances and have no idea where to start, this course might be for you!

Jeremy from Personal Finance Club created this course all about budgeting, debt, credit scores, taxes, insurance, and more to help you build a solid financial foundation.

This course is perfect if you’re not quite ready for investing and need to get your financial house in order first.

This course doesn’t cover investing in a ton of detail (see above course if you want to learn investing!).

There is over 7 hours of content, you get lifetime access, and 20% of profits go to charity!

You can also get both courses in a bundle at a discount here!

Cash Back: Fetch Rewards

Fetch Rewards is an app on your phone that lets you scan gas and grocery recepits and redeem points for gift cards!

You can take a picture of your receipt or connect your email for online shopping.

Use my link (or referral code E4PKAE) to get 2000 free points after you snap your first receipt!

Cash Back: Rakuten

Rakuten is a cash back shopping app that will send you a check every couple of months with the cash back you earned.

Simply install the browser extension or shop from the app on your phone, make a purchase, and wait for your money to arrive via Paypal or check.

I personally love using this for holiday shopping and when I need to stock up on items! The cash back amounts vary and change over time, but usually they’re between 2 and 10%.

If you join with my link and spend $30, we both get $30 in cash back!

Credit Card: Chase Freedom Unlimited

If you use credit cards responsibly (you pay them off every month and aren’t tempted to overspend), then the Chase Freedom Unlimited card might be great for you!

There’s no annual fee, 3% cash back on dining and drugstores, plus 1.5% cash back on everything else. You’ll also get travel insurance, fraud protection, and access to the Chase Ultimate Rewards portal to redeem points for travel.

I personally use this card, put almost all of my monthly expenses on it, and then pay it off every week. Check it out here!