The new 2021 Ford Bronco was revealed a couple of weeks ago and caused quite a stir on the internet. First-edition reservations sold out the first night, ford.com actually crashed because of all the traffic, and “Ford Bronco” was the number 1 search on Google the night of the reveal. It’s a pretty big deal.

I love the Bronco. I want a Bronco. The Bronco Sport with a grey roof in the Badlands trim is everything that I love about a small SUV (minus a naturally-aspirated V6 engine). The only bad thing about this truck is the price tag. My built-and-priced Bronco Sport with the 2.0L turbo would cost me $36,000!

I go through these brief periods once I’ve made a decision on something to consider literally every other option and run the numbers. I know that I’m going to buy a 2017 Ford Escape S (I already bought Weathertech floormats for it!), but I recently thought about buying a 2020 Escape Hybrid since it gets a combined 40 mpg. Would the decreased spending on gas be worth the price?

Then the Bronco was revealed. What does it really cost to buy one?

I made a spreadsheet to compare the total cost of ownership for these vehicles over a 10-year period. Now, I’m going to take you through it and show you why buying a new car has enormous, hidden costs that many people don’t realize. Then you’ll see why I’m sticking with the original plan to buy a used, economy vehicle that meets all my needs and nothing more. You can get a copy of this spreadsheet on my Etsy shop here!

How much does getting what you want really cost you? Let’s find out.

The Contenders

2017 Ford Escape S

Basic, reliable, simple. It’s everything I need and nothing more.

2020 Ford Escape SE Sport Hybrid

New technology and up to 46 MPG? Is the added fuel economy and tech worth it?

2021 Ford Bronco Sport Badlands

Here, I’m going all-out with what I want. 2.0L turbo, leather package, adventure-mobile. I love the boxy look and grey roof.

Assumptions

I am going to use my own personal car-buying situation and handy-dandy Excel template to run some numbers. We’ll compare my options along with the total cost of ownership of each one. We’ll look at 4 different areas of car ownership that cost you money: the actual price of the vehicle, total interest paid (if financed), fuel costs, and depreciation.

First things first: I currently have $15,000 saved for a car right now, so I will assume a $15,000 down payment on the 2 new vehicles. The 2017 Escape was paid in cash. I assume that each car will be kept and driven 15,000 miles a year for 10 years.

I am excluding insurance and maintenance costs from this analysis, since they will likely be pretty similar. The 2017 used Ford Escape with 50,000 miles might have slightly higher maintenance costs, but the two new cars will likely have higher insurance premiums, so we will assume that those balance out for the purpose of this analysis.

Here’s the summary:

How They Stack Up

Financing Costs

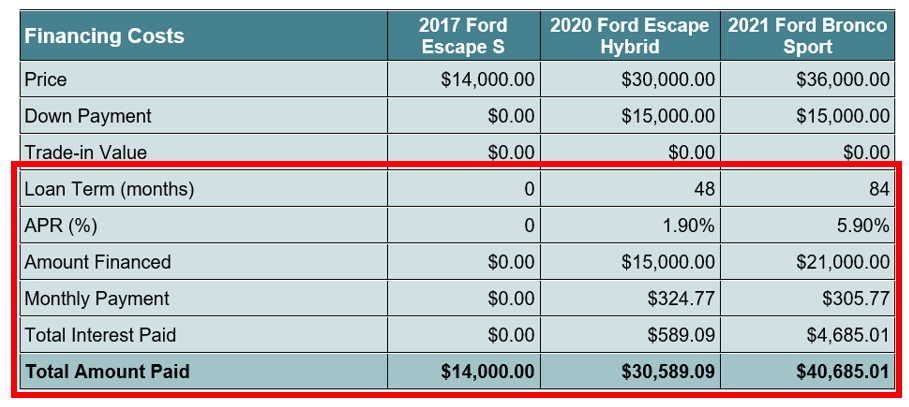

A 2017 Ford Escape S with 50,000 miles is worth about $14,000 now. Note how it’s only 3 years old and has lost almost half it’s original value! There are no financing costs associated with this vehicle, as I had enough money in the bank to purchase it outright.

The new Escape Hybrid costs $30,000, I put down the $15,000 I have in the bank, and then financed the other $15,000 at 1.9% for 48 months.

Bronco Sport, on the other hand, is a little more expensive and has much less favorable financing options. It costs $36,000 and can be financed for 84 months (!!) at 5.9% (!!). My $15,000 down payment makes it a little more bearable, but that’s a terrible loan.

The loan terms mentioned here and shown below are actual terms from the Ford website at the time of writing. You can use the “build and price” feature on any automaker’s website and it will show you the financing options. Not surprisingly, the default option is usually the worst one.

Check out the monthly payments and total interest paid here:

Total Interest Paid

At first glance, the monthly payments on the 2020 Escape Hybrid and the Bronco Sport are pretty similar given the difference in cost. But look at that difference in total interest paid!

Have you ever taken a moment to realize how much total interest you end up paying over the life of a loan? A higher interest rate and longer loan term means you’ll pay more in interest.

The 2017 Escape obviously has no interest, since this car was paid in cash. However, the Bronco loan has you paying almost 8x more in interest than the brand-new Escape Hybrid! This means that you would pay over $40,000 for a $36,000 car that will lose over half it’s value before you’re done paying off the loan.

Another thing to point out is that even though I put down $15,000 (which is a lot of money!), I’d still be paying a ton in interest for the Bronco. If you only put down 10% like the average person, you’d pay over $7200 in interest! No thanks.

Don’t forget about the total interest cost when financing a car, especially if you’re not putting any money down.

Fuel Costs

For fuel costs, I assumed $2.20 a gallon (the average gas price in Detroit right now). I took the average fuel economy for each car and approximated 15,000 miles driven per year. Doing some basic math allows us to calculate a total yearly fuel cost. I multiplied the yearly fuel cost by 10 to get a total 10-year fuel cost.

The 2017 Escape and the 2021 Bronco Sport have an average combined fuel economy of 25 MPG (engines/platforms are similar) and the 2020 Escape Hybrid has an average combined fuel economy of 40 MPG. The Escape Hybrid does save you quite a bit in fuel costs over the life of the vehicle.

The Depreciation Curve

You’ve probably heard the word “depreciation” thrown around before. But what exactly is it and what does it cost you?

Depreciation is the loss in value of an asset due to use, age, and wear and tear. Your car depreciates over time to a residual value. Residual value is simply what your car is worth when you are done using it. This can be shown as a percentage of original MSRP and as a dollar amount.

Depreciation can be represented on a residual value vs. vehicle age curve. I approximated depreciation for each vehicle from caredge.com‘s average Ford depreciation curve. They have curves for every make and model, so definitely check them out!

I plotted their average data for the most popular manufacturers and then averaged all of those curves (orange line). Search your specific make and model on their site to get a more accurate curve if you want. We’ll stick to the average Ford curve for this study.

Since we are assuming a 10-year ownership period, we want to figure out what each of these vehicles will be worth in 2030.

Depreciation Costs

In 2030, the 2017 Ford Escape will be 13 years old, the 2020 Escape Hybrid will be 10 years old, and the 2021 Bronco Sport will be 9 years old. I looked up the depreciation percentage from the average Ford curve for that year. Multiply this percentage by the car’s original MSRP when it was new, and you have the residual value of the car!

The 2017 Escape is now 13 years old, which isn’t shown on the chart. After 10-12 years, car depreciation is considered negligible. Once cars are this old, the value really depends more on the condition and mileage of the vehicle. I used the 12-year-old residual value percentage from the Ford curve for the 2017 Escape. We’ll assume it’s still in good condition with average mileage.

Cars that are older than 12 years do still depreciate, but the rate of depreciation is so small that you can often ignore it.

Calculating Depreciation Costs

Calculate the depreciation cost by taking the price you paid minus the car’s residual value after the 10-year ownership period.

Does that depreciation cost scare you yet? It’s sneaky because the dealer isn’t going to tell you, “Oh, by the way, this car will cost you an extra $25,000 over the next 10 years!” when you purchase a new vehicle. Also, consider that the average person keeps their car for only 6 years.

The number one cost most people forget about when buying a new car is depreciation. It doesn’t matter how fancy and expensive the car is, it will always end up being worth nothing when you’re done with it. In this case, buying a 3-year-old car saved me over $16,000 in depreciation costs! The used Escape only ended up being worth a couple thousand less than the new cars after 10 years.

Total Cost of Ownership

Now, it’s time to add up all of the costs that go into owning a vehicle for 10 years (minus maintenance, repairs, and insurance). To get the total cost of ownership, I added up the price paid for the vehicle, total 10-year fuel cost, total interest paid, and total depreciation.

Can you believe that a brand-new $36,000 car will end up costing you more than $80,000 over the course of 10 years?! And that doesn’t even include maintenance or insurance!

The 2017 Escape ends up costing you less than half of the new Bronco Sport over a 10-year period. Also, note that the fuel economy benefit of the Escape Hybrid did almost nothing to reduce the total cost of ownership to a level comparable to the used Escape. It’s still a $24,000 premium to drive the new car and costs you almost $62,000 overall!

Don’t forget the total cost of ownership when considering your next vehicle.

Your Interest Rate Doesn’t Matter That Much

Financing for a longer term at a higher rate will cost you a few grand in interest. But notice how small that interest cost is compared to the total cost of ownership. The heaviest hitter (besides actual vehicle cost) is depreciation. When you’re done with it, this car is only going to be worth about 20% of its original value, costing you $26,000 over the course of 10 years!

Cars depreciate the most during the first 3-4 years. It’s best to let someone else take that hit, and save yourself some serious cash. In my first example, the used car only cost me $9900 in depreciation, whereas both of the new ones were well over $23,000.

Food for thought: what you could you have done with the money you lost in depreciation on your car? Retirement, house down payment, saved for a different car in cash? These are big things!

Think about how much money you would have if you invested that car payment instead! (I’m thinking another blog post on opportunity costs in the future!)

The Best Way to Buy a Car

So now that you fully understand why you shouldn’t buy a new car, what’s the right way to buy a car when you do need one?

Like I mentioned above, cars depreciate the fastest in the first 3-4 years. So buying a 3-to-4-year-old car is the best bang for your buck when considering the total cost of ownership. 4-year-old cars are still really reliable and nice! You can often find great deals on lease trade-ins. These cars have low mileage and have usually been maintained well.

If you want to go really cheap and are decently handy (or know someone who is!), keep doing repairs on your beater. The longer you drive your car, the more money you’ll save over time.

My favorite way to buy a car is with cash. I do not like having payments, and I especially do not like having payments on items that are guaranteed to go down in value. When your car is getting old (8-10 years) think about saving a few dollars each month in a sinking fund for a new car. Have a goal of how much you want to spend and how many months until you want to buy. Take the total amount you’ll need and divide it by the number of months you have to save. Voila, you have a monthly savings goal!

If you’re in the market for a new car and don’t know where to start, check out my Used Car Buying Guide:

For now, you’ll still find me rolling around in my 2004 Ford Escape for another year or so. My new-to-me car sinking fund is complete and I’m almost ready to buy (cash, of course). You’ll continue to see me driving used cars until my net worth is at least a million dollars.

Now you know why.

Interested in doing your own car loan/total cost of ownership analysis? Head over to my Etsy shop to get this calculator for yourself so you can compare your options! Compare up to 5 vehicles with Excel formulas and a depreciation schedule already included. There are also instructions that walk you through what I did in my analysis here. Don’t let another car payment keep you from building wealth!

-Megan

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: 3 Actionable Personal Finance Rules to Help You Live Below Your Means - Megan Makes Sense

Pingback: The Top 5 Worst Money Mistakes to Avoid in Your 20's - Megan Makes Sense

Pingback: The Ultimate List of Investing Terms Every Beginner Investor Needs to Know - Megan Makes Sense