Everyone has made at least a few money mistakes in their lifetime. Your 20’s are filled with so much change and self-discovery that learning to avoid making mistakes with your finances can easily fall down the priority list.

If you didn’t talk about money growing up or have a decent personal finance class in college, you might not even realize some of the money mistakes you should avoid!

Learning more about money management and budgeting is a process. You won’t learn everything overnight and suddenly be great with money the next day.

But learning how to avoid these common financial mistakes in your 20’s is a great place to start!

If you’ve made financial mistakes in your 20’s, that means you have time to learn from them and recover!

However, if you remain in the dark about your finances for too long, it will be tough to catch up.

The financial habits you create in your 20’s can make or break your financial future! I can’t emphasize enough how important money management is when planning for your dream life.

I’ve compiled this list of 5 money mistakes to avoid in your 20’s based off of what I’ve seen in my clients and peers. This list isn’t fully comprehensive (you can always find more financial mistakes!), but these are the 5 most common mistakes I’ve seen in my experience as a personal finance coach and enthusiast.

5 Money Mistakes to Avoid Making in Your 20’s

I want to preface this by saying that this post isn’t meant to shame anyone for making these mistakes. EVERYONE makes mistakes.

If you’ve done any of the below things, that’s okay! The goal is to learn from your money mistakes and make changes for next time. It’s never too late to get better with your personal finances!

Money Mistake #1: Buying a Brand-New Car

I’ve seen so many of my friends finance a brand-new car the moment they graduate college and start their first job. New cars lose 50% of their value in the first 5 years, which is YOUR money going down the drain!

A new car is a luxury, not a neccessity.

Plus, when you’re a new grad, there are so many other financial priorities that are way more important than looking cool at a stoplight.

Starting your emergency fund, working on paying back your student loan debt, and working on your retirement investing are all much better uses of your hard-earned salary.

Your 20’s are also probably the cheapest you’ll ever live (life will always get more expensive- kids, marriage, buying a home, etc). Inflating your lifestyle with a luxury purchase on an entry-level salary is never a good idea.

Autotrader also reports that 69% of car buyers had buyer’s remorse after purchasing a car. The new car smell wears off after a few months, but your $600 car payment doesn’t!

I drove my high-school car for 2 years after I started my first job! I took pride in keeping it clean and maintained, so I didn’t care that my car was old.

Because I didn’t have a massive car payment, I could afford to travel more while paying down my student loan debt and saving my emergency fund.

Do yourself a favor and avoid making this money mistake in your 20’s. If you really need to purchase a car, a 3-5 year-old used sedan or compact SUV will serve you just fine.

Check out more of my posts on car buying:

- 4 Detrimental Facts About 0% APR Car Loans That All Car Buyers Should Know

- 8 Important Things to do After Buying a Used Car

- The Hidden Costs of Buying a New Car

Money Mistake #2: Not Saving for Retirement

One of the worst money mistakes to avoid in your 20’s is not saving for retirement!

According to CNBC, only 39% of Americans started saving for retirement in their 20’s!

I hear people say that they’ll save for retirement when they make more money, that they’re too young to worry about retirement, etc. Bad idea!

Even if you don’t make much money now, building the habit of living below your means and saving for the future is a worthwhile endeavor. Work on creating enough margin in your budget to save just $50 or $100 a week into a Roth IRA.

When you’re young, it’s less about the amount you save, but how much time in the market you have.

Consider a 25-year-old that starts contributing $500 a month toward retirement. Plug $500 per month at an 8% return for 40 years into an investment calculator, and see that they will have $1.6 million at the traditional retirement age of 65!

Wait until age 35 to start saving, and you’d only have $704,000 at 65 under the same conditions. That person would actually need to save about $1150 per month to reach that $1.6 million goal! That’s more than double the monthly investment amount than if you had started saving at age 25.

Cutting just 10 years off your compound interest timeline makes a huge difference in your retirement nest egg. Not investing early and often is a mistake I see a lot of people in their 20’s making!

Avoid This Money Mistake: Tips on Saving for Retirement in Your 20’s

The best place to start saving for retirement is with your employer 401k plan. You elect to contribute a percentage of your salary toward your 401k and it comes direcly out of your paycheck. Do this as soon as you start your job so you’re used to not seeing that money!

If you get a retirement match at work, make sure you are contributing enough to get the full match.

This benefit is built into your salary and is a 100% guaranteed return on your money before it grows in the stock market! Do not forgo your company match for any reason (I don’t care how much debt you have!).

The next best place to save for retirement AFTER getting your company match is in a Roth IRA. There are a ton of benefits to contributing to a Roth IRA when you’re young, so open an account now if you haven’t already!

The money grows tax-free, there are no required minimum distributions, and you can withdraw your contributions penalty-free before age 59 and a half!

Related: 5 Key Reasons a Roth IRA is Better Than a 401k After Getting Your Company Match

Money Mistake #3: Buying a House Before You’re Really Ready

Did you know that two-thirds of millennials regret buying their home?

Buying a home is a huge decision that comes with hidden costs. We’ve all had someone in our lives tell us that “renting is wasting money” and try to rush us into a home purchase.

But buying a home is wasting money too! Yes, you are building equity into an asset that tends to appreciate in value, but only a portion of your mortgage payment actually goes to building equity. Put 5% down on a $250,000 home on a 30-year mortgage and only about $400 of your $1000 mortgage payment for the first few years actually goes toward principal.

The other $600 is interest (aka, wasting money)!

You know what else is a waste of money? Property taxes, private mortgage insurance, closing costs, maintenance, repairs, HOA fees, and home insurance.

I am not saying that buying a home is a bad idea. In fact, it’s probably a great long-term plan to improve your quality of life and build your net worth. But it’s important to be ready with an emergency fund, down payment, and understanding of what home ownership really costs.

Do you even like the area that you’re considering buying in? How safe is the neighborhood? Is it in a good school district? Will the home need any major maintenance (roof, furnace, windows) soon?

Don’t let your broke uncle talk you into a home purchase that you’re not quite ready for. Renting modestly and/or with roommates is a great way to save money until you’re actually ready to buy.

Money Mistake #4: Ignoring Student Loan Debt

69% of students in the class of 2019 took out student loans and graduated with an average debt of almost $30,000!

I’ve heard so many people say that they’ll never pay off their loans, they’re waiting on loan forgiveness, or that they’re ignoring them altogether!

Newsflash: the government isn’t going to pay off your loans, even if you’re eligible for federal student loan forgiveness. Only .3% of borrowers get their loans forgiven!

Your 20’s are the perfect time to face your debt and create a plan to pay it all off. You probably don’t have kids yet and can live relatively cheaply, so take advantage!

Ignoring your student loans won’t make them go away. Get on a budget, make some sacrifices, and create a student loan debt payoff plan to get rid of them ASAP.

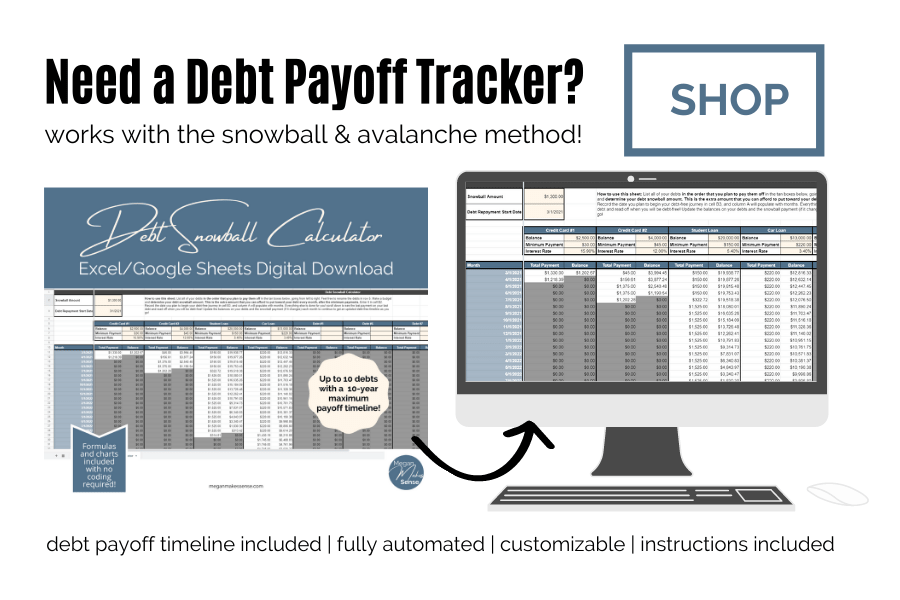

This debt snowball tracker can help you organize your loans and project a debt payoff date!

Money Mistake #5: Failing to Live Below Their Means

The biggest financial mistake I see people in their 20’s making is not living below their means. This one is pretty simple: don’t spend more money than you make!

Living below your means gives you a gap between your income and expenses to save and invest for the future.

This is the ultimate of all money mistakes that America is trapped in.

Keeping up with the Joneses, consumerism, and instant gratification have plauged our society for decades. The constant need upgrade your lifestyle in order to show off keeps us trapped in the cycle of consumer debt and always wanting more.

But what if you just decided not to care what others think?

You can choose to invest your bonus from work instead of buying a new couch.

Happily drive your 10-year-old car because you just washed and vacuumed it, and there is no better feeling than a clean car.

Take a less-Instagrammable camping trip with your family vs. spending $10,000 on a vacation to Paris that you won’t really enjoy.

Choose to live simply so that you can build wealth and acheive financial freedom. The ultimate money mistake to avoid is living a stressful life by spending all your money on things you don’t really like to impress people you don’t really care about.

“And I saw that all toil and all achievement spring from one person’s envy of another. This too is meaningless, a chasing after the wind.”

Ecclesiastes 4:4

Have you made any of these money mistakes? What else would you add to this list? Let me know in the comments below!

I’d love to hear from you!

-Megan

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: 5 Ways I Don't Follow the Dave Ramsey Method (and Why You Shouldn't Either) - Megan Makes Sense

Pingback: 8 Important Things to Do After Buying a Used Car to Save Money in the Long-Term - Megan Makes Sense

Pingback: 0% APR Car Loan: The True Meaning Behind Interest-Free Financing Deals - Megan Makes Sense

Pingback: 6 Proven Strategies to Avoid Lifestyle Inflation - Megan Makes Sense

Pingback: 7 Limiting Beliefs About Money That are Preventing You From Building Wealth - Megan Makes Sense