Learning about investing can be overwhelming, frustrating, and downright confusing! There are endless articles littered with investing terms that seem impossible to understand.

Financial advisors and “gurus” overcomplicate things to confuse you and make you feel like you have to use their services in order to be successful at investing as a beginner.

What if I told you that you could learn a few “investing 101 for beginners” terms and do it all yourself?

Good investing is simple and boring with a long-term mindset. You don’t have to read Yahoo Finance every morning and continually track what the market is doing. And you absolutely don’t need to use a financial advisor.

You can learn how to invest and manage your own portfolio to build wealth, even as a total investing beginner. You just have to invest the time and effort it takes to get there (pun intended).

I was in your shoes just a few years ago. Completely confused and googling every financial buzzword that I didn’t understand.

Through a lot of self-education, hours watching Youtube videos, and endless googling, I now confidently self-manage all of the investments inside of my Roth IRA, HSA, and 401k.

And I’ve also rounded up this list of 23 common investing for beginners terms to help you do it too!

While you don’t need to know everything about investing to get started, it is helpful to get familiar with some of the investing terms and lingo.

This post is all about the 23 essential investing terms every new investor needs to know.

23 Essential Investing Terms Every Beginner Investor Needs to Know

It’s important to know the difference between investing your money and saving your money. The two sometimes get used interchangeably (ever heard the term “saving for retirement” when it really means “investing?”).

Saving your money means putting it in a savings account with a super low interest rate. If you only saved money, your purchasing power would continually erode over time due to inflation. You would be broke!

Investing your money means that you purchase stocks, bonds, mutual funds, etc (more on this below- don’t freak out yet!) inside of an investment account. Your money will take advantage of compound interest over a long period of time and grow exponentially.

Only save enough money for an emergency fund or for short-term goals (car, baby, home downpayment). Invest the rest of it so it will continue to grow and make you more money!

Retirement is a long-term goal, so that’s why we want to invest that money. Most investment accounts are retirement accounts!

This post may contain affiliate links, which means I get a small commission should you choose to purchase or sign up through one of my links, at no extra cost to you. I only recommend products that I personally use and believe in. You can read more about this in my dislcaimer.

Investment Accounts 101

Roth IRA

A Roth IRA is an individual retirement account that you fund with post-tax dollars that grows tax-free. There are income and contribution limits set by the IRS, and penalities apply if you withdraw funds before the age of 59 and a half (with a few exceptions).

Roth IRA’s are great for young workers in lower tax brackets!

Traditional IRA

A traditional IRA is similar to a Roth IRA except that you fund the account with pre-tax dollars (meaning you get a tax break now). You will pay income taxes in retirement and can start taking distributions at age 59 and a half.

There are no income limits for contributing to a traditional IRA, so they are great for high-income earners.

401k

A 401k is an employer-sponsored retirement account that allows employees to contribute a percentage of their salary through payroll deductions. Employers will often “match” a portion of an employee’s salary.

The IRS also has set contribution limits for your 401k. In 2021, employees can contribute up to $19,500 of their salary into their 401k. The employer matching contributions do not count toward this limit.

There are no income limits for contributing to a 401k and you can begin taking distributions at age 59 and a half.

Related: How to Choose the Best Funds for Your 401k Investing

403(b)

A 403(b) is the same as a 401k but for public school workers and other public-sector organizations. They usually have more limited investment options than a 401k.

Backdoor Roth IRA

A backdoor Roth IRA is a retirement savings strategy that involves contributing to a traditional IRA and “converting” it to a Roth IRA. They are popular with high-income earners that are not directly eligible for a Roth IRA.

There are income limits to directly contributing to a Roth IRA, but anyone can contribute to a traditional IRA and convert it to a Roth.

Taxable Brokerage Account

A taxable brokerage account is an investment account through a brokerage firm (Fidelity, Schwab, Vanguard, etc) that doesn’t have any tax benefits. You pay taxes on the money you put in, and you’ll also pay taxes on your investment gains upon withdrawal.

The draw to a taxable brokerage account is that there are no penalties for withdrawing money before traditional retirement age. The money is completely liquid to you at all times!

These accounts can act as a “bridge” for early retirement until you can access your retirement accounts without penalties.

I’d recommend contributing at least 15% of your income to retirement accounts before investing into a taxable brokerage account.

Investment Vehicles

I’m not talking about cars here- cars are terrible investments! These investing terms refer to the different types of assets that you can buy inside of your investment accounts.

Stock

Shares of a stock represent a fractional ownership into a publicly-traded company. It is an investment into a company and it’s profits.

Bond

A bond is a form of corporate debt. You can think of a bond as an IOU plus a little bit of interest.

Investors buy bonds in exchange for a “coupon” that says the company will pay you back in XX amount of time plus XX interest rate. Investing in secured bonds is a “safe” investment since there is a guaranteed rate of return.

Because secured bonds are less risky, the interest rates are often much lower than investing in stocks, mutual funds, etc.

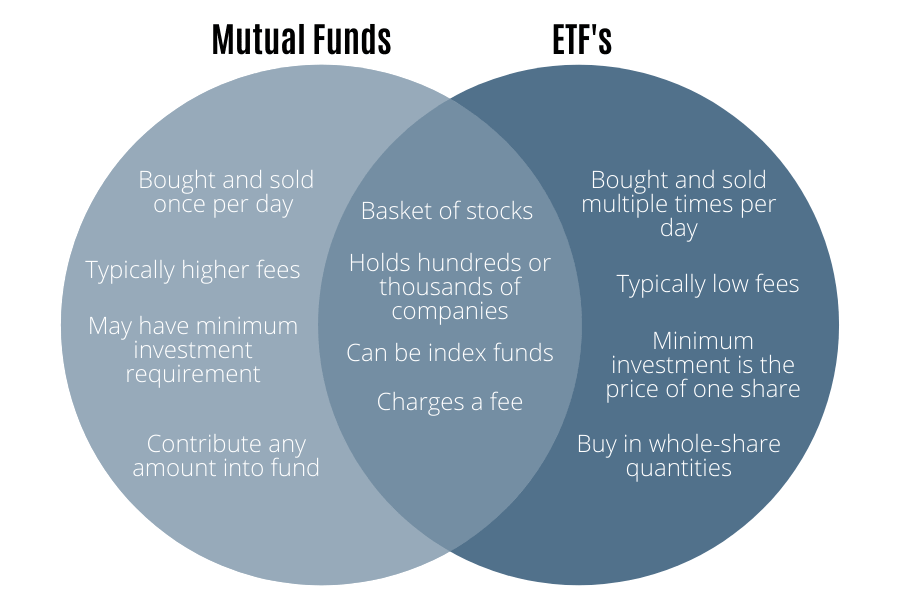

Mutual Fund

A mutual fund is a professionally-managed portfolio of stocks and bonds packed into one fund. Instead of buying hundreds of individual stocks, you can purchase a mutual fund and get a bunch of stocks in one basket.

A mutual fund may have shares of hundreds or thousands of companies included in it.

Some mutual funds are actively managed. Because these types of mutual funds get managed professionally, they often have high fees and expense ratios associated with them.

Many actively-manged mutual funds claim to outperform the market index, but few rarely do over the long term.

Other mutual funds are passively-managed. They track a market index, and in turn, don’t charge a high fee. This is why they’re often called “index funds.”

There may also be a “minimum investment” required for some mutual funds (Vanguard has a $3000 minimum for many of their funds). This means that you’ll need to deposit at least $3000 the first time you buy a Vanguard mutual fund.

Mutual funds trade once per day on the New York Stock Exchange and you can deposit money in any increments.

Exchange-Traded Fund (ETF)

An ETF is very similar to a mutual fund. Both are collections of stocks packaged into one product. However, ETF’s trade like a single stock (prices fluctuate throughout the day). The minimum investment is the price of one share.

ETF’s usually aim to passively track a market index instead of beat it. Therefore, they are also commonly referred to as index funds and have ultra-low fees.

The only downside to an ETF is that you have to purchase them in full quantities. If you have $70 to invest and the price of one share is $60, you could only buy one share and will have $10 left over.

Index Fund

An index fund refers to any fund that is passively managed with ultra-low fees. This means that an index fund can be in the form of either an ETF or mutual fund.

You can find many examples of the same index fund in the ETF and mutual fund version. For example, VOO is the Vanguard S&P 500 index ETF and VFIAX is the same thing in mutual fund form.

All index funds exist as mutual funds or ETF’s, but not every mutual fund or ETF is an index fund.

Target Date Fund

If you have a 401k, it’s likely invested into a target date retirement fund. A target date fund is a mutual fund that sets a “target” retirement date and rebalances the portfolio into more conservative investments as you age.

You can tell these guys apart because a retirement year will be in the name of the fund (ex: Blackrock LifePath 2060 Index). In this case, 2060 is the approximate year you would retire.

Blue Chip Stock

A “blue chip stock” simply refers to a large, financially sound company. They weather market downturns and are solid investments for the long term.

Stock Market Indexes

Market Index

A market index is a method of tracking the performance of certain industries or economies in a standardized way. They can either be broad-based (like the Dow Jones or S&P 500) or more niche (emerging markets).

S&P 500

The S&P 500 is one of the oldest and most popular stock market indexes. It tracks the performance of the 500 largest publicly-traded companies in the United States.

Dow Jones Industrial Average

Also known as the Dow 30, the DJIA tracks 30 large, publicly-traded, blue-chip companies.

NASDAQ

The National Association of Securities Dealers Automated Quotations was the first electronic stock market exchange.

The NASDAQ exchange includes over 3000 stocks at the cutting edge of technology.

Bear Market

A bear market is an investing term that refers to a prolonged period of stock price declines.

Bull Market

On the flipside, a bull market is an optimistic period of stock price increases.

Other Miscellaneous Investing Terms

Expense Ratio

An expense ratio represents an annual fee (represented as a percentage of your investment) that you pay in order to invest in mutual funds or ETF’s.

If you invest in a mutual fund with a .03% expense ratio, that means $0.30 of every $1000 invested goes toward fees.

Compound Interest

“Compounding” refers to the increase in value of an investment over time due to capital gains, dividends, and interest. When interest is compounded, it means that your previous interest earns interest, and then the interest of that interest earns interest, and so on.

Compound interest is what causes your investments to grow exponentially in the long term. Investing in index funds for the long term will make you rich because of compound interest.

Dividend

Dividends are regular payments made to investors for owning shares of stock. They typically pay out monthly, quarterly, or annually.

Asset Allocation

Asset allocation refers to balancing an investment portolio into different asset classes (stocks, bonds, cash) usually reported as a percentage (ex. 80% stocks, 20% bonds).

Dollar Cost Averaging

Dollar cost averaging means that you contribute a set dollar amount to an investment on a regular basis. It is a way to minimize risk since you’re averaging the cost of an index fund, stock, etc over time. You don’t worry about the price of one share at any one time.

Contributing $500 per month into an S&P 500 index fund inside your Roth IRA is an example of dollar cost averaging.

Lump Sum Investing

On the other hand, lump sum investing is where you contribute a significant amount of money into an investment in a lump sum. Contributing the full $6000 into a Roth IRA all at once is an example of lump sum investing.

A 2012 study by Vanguard found that lump sum investing outperformed dollar cost averaging 66% of the time. That percentage went up as an investment is held longer.

My advice? Contribute money to your investments as soon as you have it.

Vesting

Your 401k probably has a vesting period. Vesting refers to the time period it takes for your employer contributions to your retirement account to be fully yours. It’s the time period required for you to stay at your job so that you can take your employer matching contributions when you leave.

Most employers have a vesting period of 3-5 years.

If you leave before that time period is up, you forfeit the employer contributions to your account (you always get to keep your contributions, however).

Inflation

Inflation is the continual decline in purchasing power of the US dollar. If you look at the pirces of goods from 1950, you’ll notice how much cheaper they were compared to today!

Inflation in the US typically hovers around 2-3% per year. So far in June 2021, inflation has hit 5.4%!

This is why it is so important to invest your money! Leaving a ton of cash inside a savings account paying .05% interest means that you’re losing purchasing power every year.

Annualized Rate of Return

An annualized rate of return on an investment is a way of calculating the average rate of return per year. However, the actual annual rate of return varies widely year to year.

When you “annualize” a return, you can predict the future value of an investment by using an investment calculator.

The S&P 500 has an average annual return of around 10% per year since 1926.

Diversification

Diversification refers to spreading out your investments over different types of assets to minimize risk.

Buying an ETF or mutual fund has built-in diversification since you’re spreading your investment over hundreds or thousands of different companies.

Diversifying you investment can involve purchasing stocks/funds with different sizes of companies, US/international companies, bonds, real estate, and/or other commodities.

Basically, you don’t want all of your eggs in one basket because if that basket goes bankrupt, you’re screwed!

Final Thoughts on Investing Terms for Beginners

Hopefully this post about investing terms helps you get the ball rolling on your own investment strategy. Don’t let news articles and financial advisors overcomplicate things and stress you out!

Creating a sustainable budget, paying off your debt, building your net worth, and learning to live below your means will give you margin between your income and expenses to invest and build wealth with.

My favorite way to track my investments and net worth is with Personal Capital. Their net worth dashboard is totally free and links to all of your bank accounts, retirement accounts, and credit cards.

It only takes a few minutes to set up and watching your net worth increase over time is SO motivating! Your accounts are updated daily and the interface is very intuitive.

I like to check my numbers once a month and input them into my net worth spreadsheet!

Keep it simple by investing early and often into low-cost index funds and you will be very wealthy one day.

Go into investing with a long-term mindset and don’t freak out about short-term fluctuations.

Happy investing!

-Megan

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: 5 Key Reasons a Roth IRA is Better Than a 401k After Getting Your Company Match - Megan Makes Sense

Pingback: 5 Ways I Don't Follow the Dave Ramsey Method (and Why You Shouldn't Either) - Megan Makes Sense

Pingback: 5 Signs You're Ready to Start Investing - Megan Makes Sense