Everyone should track their net worth. Net worth is a simple way to measure how you’re doing financially, and the trend over time can give you important insights into your behavior with money.

In a nutshell, your net worth is the sum of everything you own minus what you owe. If you own more assets than you owe in debts, you’ll have a positive net worth.

Your net worth is very easy to track and shouldn’t take you more than a few minutes to calculate!

Working to increase your net worth over time will help you plan for retirement (I prefer the term “financial independence”).

The goal is to eventually accumulate enough assets in order to pay for your lifestyle, meaning you won’t need to work a traditional job to make ends meet anymore!

If you start with a negative net worth, don’t panic! I graduated college with $56,000 of student loan debt and a -$50,000 net worth.

In a little over 2 years, I was able to grow it to a positive $50,000 by budgeting, investing, and paying down my student loan debt. If I can do it, so can you!

This post will define net worth, why it’s important, and walk you through how to track your net worth.

What is Net Worth?

First, lets define net worth. Your net worth is the sum of all of your assets minus the sum of your liabilities.

Assets are the things you own that have significant value. Your home, retirement accounts, cash, and vehicles fall into the assets category.

Liabilities are debts that you owe, such as student loans, car loans, credit card debt, and mortgages.

Add up the values of all your assets and subtract your total debt owed, and you have your net worth!

This post may contain affiliate links, which means I get a small commission should you choose to purchase or sign up through one of my links, at no extra cost to you. I only recommend products that I personally use and believe in. You can read more about this in my disclaimer.

Why You Should Care About Your Net Worth

Do you want to stop working one day? Then you definitely need to give a crap about your net worth.

If you want to retire one day, you will need to make sure that the income from your assets covers your liabilities and living expenses. This is called your financial independence number.

Take your annual expenses times 25 to get a rough estimate for your financial independence number. For example, let’s say you spend $4000 a month. $4000 x 12 months x 25 = $1.2 million. You’ll need to have $1.2 million in income-producing assets to comfortably retire (aka, stop working and do what you really want to do).

So how does your net worth play into this?

The person above would need to have an income-producing net worth of at least $1.2 million.

Let’s say that same person pays off their mortgage early and can now comfortably live on $2800 per month instead of $4000. Their financial independence number (net worth) now becomes only $840,000! You’ll reach a net worth of $840,000 well before $1.2 million, meaning you can retire sooner!

The earlier you start paying attention to your investments, debt, and net worth, the easier it is to put together a plan to achieve your goals.

Keep reading for more information on income-producing assets, types of liabilities, and how to increase your net worth!

Types of Assets

Let’s discuss the different types of assets a little more in-depth. We’ll divide them into income producing (aka, they make you money and provide income) and non-income producing (they don’t provide an income) assets.

Cash

Cash is an obvious asset. Your checking and savings account balances are assets because you can exchange them for goods and services.

It’s important to keep enough cash on hand for emergencies and short-term savings goals, but keep in mind that it loses value due to inflation every year. Inflation generally hovers around 2-3% per year, so your cash is actually losing value over time!

A checking account is a non-income producing asset since you generally don’t earn any interest in a checking account.

A savings account is technically an income-producing asset, since it does earn interest every month. However, this amount is tiny! Even high-yield savings accounts are only paying .5% interest these days.

Keep a 3-6 month emergency fund and any other short-term sinking funds in cash and invest the rest!

Retirement/Investing Accounts

Your 401k, Roth IRA, health savings account, brokerage account, 529 accounts, and pensions are all income-producing assets. Since they are invested (hopefully into low-cost index funds!!), they appreciate in value and pay dividends that generate income.

Once you invest enough money that produces enough yearly interest and dividends to pay for your annual expenses, you have reached financial independence! It’s awesome because if you do it right, you’ll never run out of money.

Your retirement accounts are the most important component of your net worth. They are often the only income-producing assets many people own and depend on for retirement.

Related: 5 Key Reasons a Roth IRA is Better Than a 401k After Getting Your Company Match

Real Estate

Probably the biggest asset you own (if you’re a homeowner) is your house!

It’s important to differentiate between a primary residence and investment real estate. Your primary residence is a non-income producing asset, for obvious reasons. You don’t generate income by living in your home, (unless you rent out a bedroom or basement).

It’s important to not buy too much house, or you’ll be house poor. Being house poor simply means that a huge portion of your income goes to paying the mortgage, so there’s not much left over for savings or income-producing investments.

A good rule of thumb is to aim for a mortgage payment between 25-30% of your take-home income. That leaves enough margin in your budget to save and invest!

Investment real estate (properties that you rent out, flip, or make money on) are income-producing assets. Rental income is a great way to make semi-passive income to supplement your lifestyle or reinvest into other assets! However, investment properties require a lot more work than a retirement account does.

Buying a home that you can actually afford is usually a good decision for most people. Once the mortgage is paid off, you no longer have a housing payment and you own an asset that generally goes up in value!

On the flip side, if you buy too much home and don’t have enough left over to invest into income-producing assets, you’ll be house-poor and unable to retire comfortably.

You don’t absolutely need to have your home paid off before you retire, but you’ll need to make sure that your planned investment income will cover that monthly mortgage payment.

Vehicles

The last asset category we’ll discuss is vehicles. Cars, trucks, boats, motorcycles, anything with wheels and/or a motor.

Vehicles are non-income producing, depreciating assets. This means that they go down in value over time.

You’ll want to minimize your spending on these types of assets because you don’t want too much of your net worth tied up in stuff that goes down in value. The average new car depreciates almost 50% in the first 5 years! Tie up most of your net worth in cars and your net worth will decrease at a similar rate.

Pretty much everyone needs to own a car, I’m not denying that. I also don’t believe that you need to drive a $2000 beater your whole life either! A good rule of thumb is to buy a 3-5 year-old car and drive it for as long as possible to minimize your depreciation costs.

Related: The Hidden Costs of Buying a New Car

Other Assets

These 4 types of assets we just walked through are the most common, but you may have other items that have significant value as well. Antiques, wedding rings, or collectibles that you could sell for a significant chunk of change could also be included in your net worth.

I would personally skip these types of items because they’re difficult to appraise and don’t produce income. Including too many of these types of assets could inflate your net worth to a falsely-high value as well.

Plus, you’ll probably value your Beanie Baby collection a lot higher than the market would!

Types of Liabilities

Liabilities are debts that you owe. Student loans, car notes, credit card debt, or any other loan that you have is a liability.

Paying off debt is a huge part of any wealth-building journey. How quickly you choose to pay it off depends on your risk tolerance, interest rates, and a bunch of other factors. Paying off debt (aka, decreasing your liabilities) will also increase your net worth!

Liabilities are also risks. If you lose your job, you still have to make your car and student loan payments. All of those minimum payments add up, and require you to make enough income to cover those payments. Debt payments also eat up a chunk of your income that could be used for saving, investing, and building wealth.

Let’s walk through the most common liability examples.

Student Loans

The average millennial has $33,000 of student loan debt, making it one of the most common liabilities out there. It should definitely be a priority to get rid of that student loan debt quickly! The interest rates are higher than you would think.

You don’t want to be that 50-year-old that still has student loan debt. Those people end up paying three or four times what they originally borrowed for their education. No thanks!

Car Loans

Your car loan is a liability. It is a liability on a depreciating asset.

I hate car loans. You pay interest to own something that goes down in value over time, how does that make any sense? Not to mention that investing your monthly car payment would result in millions of dollars at retirement!

Do yourself a favor and pay off your car ASAP. And do your best to not go back into debt for a vehicle again. It is possible to pay cash for a reliable, used car!

Credit Card Debt

The only other type of debt I hate more than a car loan is credit card debt! Credit card companies are very predatory and can encourage you to overspend. And then they’ll charge you insane interest rates to keep you in the cycle of consumer debt.

I am not saying that using credit cards is a bad thing! They can be a great way to earn some cash back or travel points if used correctly. If you aren’t tempted to overspend and you pay the balance off in full every month, you officially have my permission to use a credit card.

If you have any outstanding credit card debt, I highly recommend that you stop using credit cards for a season. Work on paying that off ASAP! Credit card debt is the worst.

Mortgages

If I used the term “good debt,” a mortgage would be the only loan on my list. The reason people list it as a “good” debt is because mortgages tend to have low interest rates and you are borrowing on an asset that tends to go up in value.

If something really bad happened, you could likely sell your home and pay off the mortgage balance with some money left over. The difference between what your home is worth and the balance on your mortgage is referred to as “equity” in your home. Building equity in your home will increase your net worth!

Some people find it beneficial to pay off their mortgage early and some prefer to invest their extra cash elsewhere. It is true that you’ll likely make more money by investing in the stock market vs. paying off your 3% mortgage. But having a paid-for home decreases your monthly expenses, and feels pretty dang good!

I won’t get mad at you if you keep your mortgage or if you decide to pay it off early!

Other Unsecured Debt

Medical bills, personal loans, and family loans all fall under the “unsecured debt” umbrella.

Unsecured debt simply means that the lender doesn’t have an asset to repossess if you stop paying the loan. Student loans and credit card debt also fall into the unsecured debt category.

If you stop paying a car loan or mortgage, the bank will come and take your car or house. No one is going to come take your diploma if you stop paying a student loan, and you can’t “return” your education.

Please please stay out of unsecured debt at all costs. Avoid payday lenders like the plague. They are very predatory and will offer you loans at astronomical interest rates that make it very difficult to pay off.

Also keep in mind that if you owe money on your cell phone, mattress, sofa, or appliances, that counts as debt too!

Watch out for those 0% offers that have a skyrocketing interest rate if you don’t pay it off within a certain timeframe.

How to Increase Your Net Worth

Like I mentioned above, your net worth is your total assets minus your total liabilities. It then becomes a simple math problem to calculate and track your net worth.

How to increase it? Increase your assets (top line) while decreasing your liabilities (bottom line).

Increase your assets by saving an emergency fund, investing more for retirement, or purchasing assets (preferably appreciating assets, not cars and consumer goods!).

Keep in mind that the value of your assets may be out of your control (for example, the balance on your 401k could decrease in the short-term depending on what the market does).

This DOES NOT mean that you shouldn’t invest when the market is down because you’ll “lose money.” The markets always go up in the long-term.

Compound interest will eventually do the heavy lifting for you, but you need to contribute money to give it something to lift! And contributing money to your investments will increase your net worth!

So don’t put too much emphasis on your 401k or Roth IRA balance day-to-day. Keep plowing money away and you will see your net worth grow over time.

Decrease your liabilities by paying off debt. This is the safest way to increase your net worth until you are debt-free.

If you pay an extra $500 to your student loan this month, that automatically increases your net worth by $500. However, you could have contributed that $500 to your Roth IRA instead, and maybe the market goes down the next day. Therefore, that $500 wouldn’t have gone as far had you used it toward your student loan.

Markets decreasing is a risk you take when you choose to invest for the short-term (investing in good, low-cost index funds over the long-term is not considered a risky investment). Maybe your net worth actually decreases for a period in the short-term.

By the same token, your money could have also grown in your Roth IRA in the short-term as well. In that scenario, the $500 would have increased your net worth more than if you had used it on your student loan. You have to decide how much risk you are willing to take on when deciding whether to pay off debt or invest when growing your net worth.

Paying off debt is a guaranteed, dollar-for-dollar, net worth increase in the short term.

However, you NEED to invest over the long term to grow your net worth and build wealth.

You will want to track your net worth and make sure that it is trending upwards over time by paying off debt and investing your money into income-producing assets.

How to Track Your Net Worth

Tracking your net worth comes down to that simple formula: assets – liabilities.

You’ll want to continue calculating it over time though (to make sure it’s going up!) as you invest into assets and pay down your liabilities.

Here are my favorite ways to track my net worth over time!

How to Track Your Net Worth with Personal Capital

If you’re looking for an almost automatic way to track your net worth, you should definitely check out Personal Capital’s net worth dashboard. It’s totally free and super intuitive!

You import all of you retirement accounts, bank accounts, credit cards, and other loans and Personal Capital will automatically calculate your net worth for you! (They even had my employer’s 401k as an option on their dashboard!)

And if you can’t find an account, you can always enter it manually.

Here’s what the dashboard looks like:

They also have budgeting tools and retirement calculators. I personally haven’t used anything other than the net worth dashboard, and it’s worth signing up just for that. It’s that good, ya’ll.

The only major hang-up I have with it is that I have to refresh my 401k account pretty often. But everything else works seamlessly!

Sign up for a FREE dashboard here!

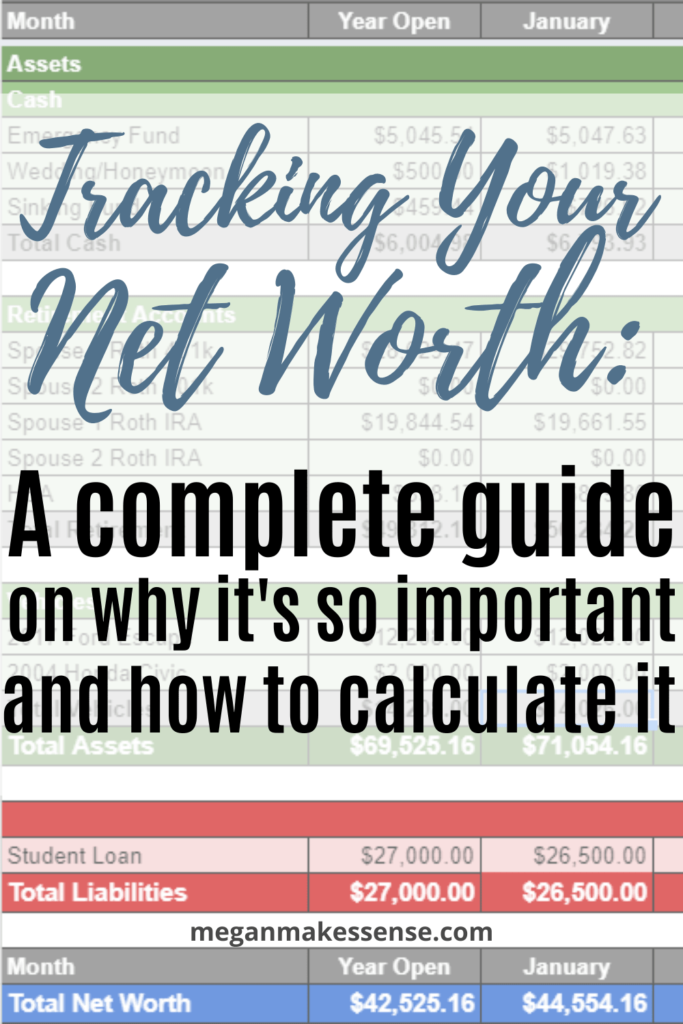

How to Track Your Net Worth Manually

For those of you who are more spreadsheet or pen and paper oriented, you can also easily track your net worth manually!

Even though I love Personal Capital, once a month I go into my net worth tracker spreadsheet and update it there as well. I like being a little more hands-on with my finances and having the data stored all in one place.

I’ve found that if you completely automate all of your finances, it’s easy to forget about it. Remember, you want your budgeting method to cause you to make decisions and be proactive with your money.

Logging into your budgeting app to see what the damage is after a weekend out (and not consciously making decisions based on that data) is not budgeting!

Personal Capital makes this process so much faster because I just have to log into one account to get the data vs. logging into my 401k, my Roth IRA, my husband’s 401k, etc.

Alright, here’s how you do it manually:

Grab a piece of paper, my spreadsheet, or however you like to keep track of your finances.

1. List your assets and their values

- Appraise your vehicles with Kelley Blue Book (make sure to use the private party value, I go with the middle number but the lower value will give you a more conservative estimate).

- Get an estimate for your home’s value (if applicable) with Zillow or Homesnap (I know it’s not the most accurate tool, but getting a home appraisal every month or quarter just isn’t feasible).

- Check the balances on your retirement accounts and list them in your spreadsheet or piece of paper.

- Record the amount of cash in your savings accounts as well. You can also include your checking account here if you wish (I personally don’t include it, as that money is seen as “spent” in my mind and set aside for my monthly expenses).

- Add up the total for all of your assets (my spreadsheet will have this part done for you).

2. List your liabilities with their balances

Now, it’s time to do the same thing with your liabilities.

Record all of your debts and the balances on each. Add them up (again, my spreadsheet will do this for you).

3. Subtract your total liabilities from your total assets

Subtract your total liability number from your total asset number. This is your current net worth!

If your net worth is negative right now, don’t freak out. I started out with a -$50,000 net worth and my husband and I are debt-free with a +$100,000 net worth 2.5 years later.

Hard work and sound financial planning will get you trending in the right direction very quickly!

Pat yourself on the back for calculating the most important personal finance number and starting your wealth-building journey!

How Often Should You Calculate Your Net Worth?

There really isn’t a hard and fast rule for how often you should calculate your net worth. I personally do it once every month, at the end of every month.

I’d recommend running a net worth calculation at least once a year to make sure you’re on track. Do what works best for you!

Calculating your net worth daily is probably too often, and checking in every 5 years is probably not often enough.

Somewhere in between is great!

My template is set up for a monthly calculation, but you can easily modify my spreadsheet to do it quarterly, yearly, biweekly, etc.

Or just sign up for a free Personal Capital dashboard if you’re looking for a more hands-off approach.

Work on paying off your debt and investing into income-producing assets and you’ll be golden.

Happy wealth-building!

Did this post help clarify any confusion about net worth? I’d love to know in the comments!

-Megan

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: Combining Finances After Marriage: A Complete Guide & Checklist - Megan Makes Sense

Pingback: How to Choose the Best Funds for Your 401k Investing - Megan Makes Sense

Pingback: The Best HSA Account Tips to Boost Your Retirement Savings - Megan Makes Sense

Pingback: 0% APR Car Loan: The True Meaning Behind Interest-Free Financing Deals - Megan Makes Sense

Pingback: The Ultimate List of Investing Terms Every Beginner Investor Needs to Know - Megan Makes Sense

Pingback: How to Save Your First $100k - Megan Makes Sense

Pingback: 3 Actionable Personal Finance Rules to Help You Live Below Your Means - Megan Makes Sense

Pingback: The Top 5 Worst Money Mistakes to Avoid in Your 20's - Megan Makes Sense

Pingback: The Complete Beginner's Guide to Saving for Retirement - Megan Makes Sense