Pretty much everyone will have the experience of buying a car sometime in their life. Aside from your home, purchasing a vehicle will likely be the biggest financial decision you’ll make!

I went through the whole car buying journey 2 years after graduating college. After getting dangerously close to financing a brand-new SUV 6 months after graduation, I finally came to my senses and decided to save up and pay cash for an older, used model.

And I have no regrets about that purchase, even after a year and a half!

The truth is, most Americans are driving around in cars they absolutely cannot afford (data from Edmunds found that over 12% of car payments are over $1000. Yep you read that right- 1 in 8 car loans have 4-figure monthly payments).

How is the average American family supposed to save money and get ahead when they’re potentially spending 4 figures a month on a depreciating asset?

America has this weird love affair with cars. We love driving huge SUVs and luxury trucks to and from work just to earn money to pay our car payment!

We absolutely have to have a new car every few years to prove to our neighbors how successful we are (even though literally no one cares what kind of car you drive, and if they do, that’s weird).

And it’s making us broke!

So are car payments bad? Is it ever okay to finance a car? How do you know how much car you can really afford?

Before people start calling me tone-deaf and how out of touch I am to suggest that an average family could ever pay cash for a car, please read until the end of the post (I’ll give you some rules of thumb when it comes to financing).

It is possible to pay cash, even on an average income! It just requires some planning and research.

This post will cover 5 major reasons that car payments are bad for wealth-building, why they are keeping the middle class broke, and how to finance your next car the smart way (if you must finance).

Your car payment might be costing you more than you think.

5 Reasons Why Car Payments are Bad (and Keeping You Broke)

While I typically don’t like to make blanket statements like, “all car payments are bad,” it’s really hard for me to not feel that way after seeing the data on car loans.

Don’t let society tell you that “car payments are normal,” and “you’ll never get ahead.”

That’s total BS! Don’t take money advice from broke people.

However you choose to purchase your next vehicle, I hope you consider the following points when you make your decision on how much you’re willing to spend (in total, NOT just the monthly payment) and how you choose to pay.

1. You’re Borrowing on a Depreciating Asset

When you take out a loan for a car, you’re borrowing money that you don’t have to purchase a depreciating asset.

Cars go down in value like a rock. And with a loan, you’ll be paying interest to a bank to buy something that goes down in value!

A brand-new car will lose over 20% of its value in the first year alone! If you paid $40,000 for a new car, that’s like setting $8000 on fire in the first year.

Literally.

You ain’t getting that $8000 back, no matter what you do!

And after 5 years, that sweet new car will only be worth 40% of it’s MSRP. Assuming a 5-year loan at a 4.5% interest rate, you would have paid over $47,000 for a car that is now worth $16,000. Ouch.

Cars go down in value, it’s a fact.

Even though we all need a car to get around, it’s smart to expect this depreciation and do everything you can to minimize it.

Cars depreciate the fastest in the first 3 years of their life. So buying a car that’s 3 years old can save you 40-50% off MSRP, and it is still new enough to feel brand-new!

2. Car Loan Financing Terms Can Be Predatory

Unless you live under a rock, you’ve probably noticed car prices skyrocketing over the last 2 years.

In order to combat this, car salesmen have the perfect solution for you: just extend the life of the loan and the monthly payments are lower!

Sounds awesome right? You can drive the same car for a lower monthly payment!

Not so fast. Extending the life of the loan means you’ll pay much more in interest and have a higher risk of being underwater on your car loan (we’ll talk more about these in the next few points).

Car salesmen will do everything in their power to get you in the most expensive vehicle as possible.

And financing for 72 or 84 months means that you’ll still owe money on that car when it’s 6-7 years old. You’ll be paying your car payment along with more expensive maintenance items, such as tires, brakes, and potential repairs.

Banks and car dealerships do not have your best interest in mind when offering these loans.

Whether that’s taking advantage of a sub-par credit score and giving you a double-digit interest rate, encouraging you to purchase a more expensive vehicle than you should, or extending your loan so you end up paying thousands more in interest and end up underwater, I can guarantee that you will be making them more money!

Here’s the differences in total interest paid over the the life of a $40,000 car loan at 4.5% interest:

| Loan Term | Monthly Payment | Total Interest Paid Over the Life of the Loan |

| 36 months | $1190 | $2835 |

| 48 months | $912 | $3782 |

| 60 months | $745 | $4743 |

| 72 months | $635 | $5717 |

| 84 months | $556 | $6704 |

Even though the monthly payment on a shorter loan is higher, it also means you’ll pay thousands less in interest!

And don’t get me started on 0% APR car loans- I have a whole blog post on the truth about interest free car loans here.

Buying a car is not like buying a home (homes generally hold or go up in value and cars go down in value- big difference in risk there!).

So always keep your eyes wide open at the car dealership, and have a clear understanding of your budget and how you wish to pay BEFORE you get there.

The transaction is also much simpler when you pay in cash. You have a set amount you plan to spend, you agree on a price, and you write a check.

Badaboom, you’re done!

3. It’s Easy to Finance Way More Car Than You Should

Another reason that car payments are bad is that it’s so easy to finance way more car than you can afford (through longer loan terms).

Paying cash for a car forces you to purchase a car that you can, well, afford.

It would be almost impossible for someone making $60,000 per year to save $60,000 in cash and blow it all at once on a car.

(And a $60,000 car for a $60,000 salary is way too much car!)

However, people making a $60,000 salary walk into car dealerships every day and leave with a $60,000 car loan because they only look at the monthly payment.

True story: I once saw in a buy/sell Facebook group that a 19-year-old was selling his truck he bought 9 months ago for $70,000 because he admittedly couldn’t afford the payments and wanted to get out of his loan. Someone loaned a freaking 19-year-old kid $70,000 for a truck!

I hope he was able to get rid of the thing and learned a very valuable lesson.

Choosing to pay cash for a car ensures that you don’t find yourself in a situation like this. Paying cash forces you to purchase a car you can truly afford, because you actually have the money!

4. There is a Large Risk to Being Underwater on Your Loan

Have you ever heard the term “being underwater” or “upside down” on your car loan?

This means you owe more on your loan than the vehicle is worth. You want to avoid this situation at all costs!

The longer your loan is, the more risk there is to being underwater. And if you don’t put any money down, you’ll be underwater almost immediately!

Remember how we said cars go down in value 20% in the first year?

Let’s say you buy a brand new car for $30,000, put no money down, and finance at 5% for 72 months.

After 1 year, your car is worth $24,000 and you will still owe $25,602!

In order to combat this risk, your insurance company will probably require you to purchase gap insurance. This extra insurance (in addition to your regular car insurance bill) will pay the difference if you total the car while being underwater.

In this case, if you total your brand new car after a year, your insurance company will write you a check for the $24,000 that the car is worth, but you still owe $25,602 on the loan.

Your gap insurance will cover the $1602 difference so you can pay off your loan (since you still owe more than the insurance company gave you for your car).

You’ll have no car, and no money from insurance to buy a replacement. (Even though the car is gone when you totaled it, your loan doesn’t magically go away!).

Being underwater on your car loan is not a good place to be. It’s risky and you have to pay for additional gap insurance.

Let’s pretend that you paid cash for the same car and totaled it after a year. You would be able to use the full $24,000 insurance payout to purchase an equivalent replacement vehicle.

You won’t have to worry about paying off a loan for a car that no longer exists while figuring out how to pay for that replacement vehicle at the same time.

Here’s a secret: you’ll never be underwater on your car loan if you don’t have a car loan!

5. Car Payments Eat Up Your Monthly Cash Flow

Let’s go over some stats really quick.

- The median household income in the US is about $67,000 per year (or about $4000 – $4500 of net income per month).

- 58% of Americans are living paycheck to paycheck after the latest inflation spike.

- The average new car payment is now over $700 a month.

The math ain’t mathin’.

The average American has some severe cash flow issues.

A $700 car payment means that $700 can’t be put toward savings, retirement, or paying down other debt. And $700 per month on a $4000 per month income is a big freaking deal.

Imagine having an extra $700 per month in your monthly budget. You suddenly have room to breathe with your spending. Going over budget by a couple hundred bucks doesn’t automatically mean credit card debt.

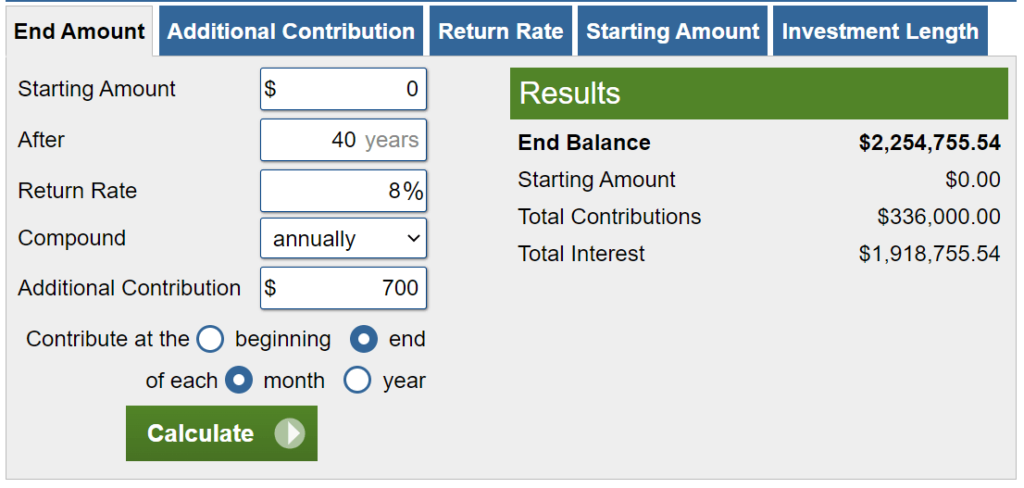

$700 per month invested in a 401k or IRA over 40 years can turn into over $2 million dollars, thanks to compound interest! The average household could retire on time, very comfortably!

If the average American paid off their car and actually kept driving it, they could keep paying themselves that $700 per month instead of the bank.

But, the average American keeps a new car for only 6 years.

Coincidentally, the average car loan term is also about 6 years.

Which means the average American buys a new car, trades it in as soon as they pay it off, and resets the car payment clock. No wonder it’s so hard for the average family to save money for their future!

Always understand the impact of monthly car payments when considering paying cash or financing a car. What else could you do with that money each month?

Pay off your car and keep driving it for as long as possible while saving up for the next car.

You’re used to making that payment anyway, so just keep paying it to yourself when your loan is paid off. In a few years, you’ll have enough money saved to buy a nice, used car in cash!

Related: How Compound Interest Completely Changed How I Think About Money

Is Financing a Car Ever a Good Idea?

I personally am not the biggest fan of car loans, for all the reasons listed above.

However, I understand that not everyone is able to save up enough cash in a reasonable amount of time to purchase a reliable car outright, without major sacrifices that aren’t worth making.

I will also give permission to those who have the money to pay in full (either in a savings account or a brokerage account), but choose to finance and keep their money in savings/invested instead.

(And if this is you, you probably don’t need this blog post!)

Maybe you just graduated college, you don’t own a car yet, and you don’t have any money saved. You need a car to get to and from work.

If you absolutely need to finance a car, make sure it follows the 20/4/10 rule. Put down at least 20%, finance for no longer than 4 years, and make sure the payment isn’t more than 10% of your monthly net income.

This rule ensures that you don’t buy too much car, you won’t be underwater on your loan, and you’ll still have enough cash flow in your monthly budget to put toward financial goals.

This car loan calculator can help you figure out your car budget.

And remember that you should really only need to finance your first car.

Once you buy that first nice used car, you’ll have plenty of time to save up cash over a few years to buy the next one when the wheels fall off your current one!

I hope this post helped you realize that perpetual car payments are bad and that car salesmen are not your friends. Yeah, you might not look as cool in the parking lot, but there is so much satisfaction in driving a car that isn’t making you broke.

Pay off your car (or buy a nice, 3-5 year-old car that has been well-maintained instead of buying new).

Keep driving it for the next 8-10 years, keep it clean and maintained, and then save up over time to replace it when the time comes.

Be your own bank and pay cash for depreciating assets.

There are much more important things to with $700 each month instead of setting it on fire with a big bad car payment.

Future you will be thankful, trust me.

-Megan

This post was all about how car payments are bad for wealth building.

Read next: 3 Actionable Personal Finance Rules to Help You Live Below Your Means

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: 10 Warning Signs That You Are Living Beyond Your Means - Megan Makes Sense