I’m sure we’ve all been told to “avoid living beyond your means” before, usually followed by no more specific advice other than “spend less than you make.”

My grandpa always warned against living beyond your means. He was a farmer, and would literally draw a spreadsheet on paper to record expenses and revenues for the farm to make sure he didn’t spend more money than he made. The OG spreadsheet nerd (now I know where I get it!).

In fact, living beyond your means is the single, most detrimental reason why most people don’t ever build substantial wealth. Spending every dollar you make (or worse, spending more than you make) is a recipe for financial disaster.

We should all strive to live well under our means so that we can invest the difference to build wealth for financial freedom and have breathing room if we lose a job or have an emergency.

But how do you know if you are actually living under your means?

And on the other hand, what are the signs that you are living well beyond your means instead?

This post will cover 10 alarming signs that you are living beyond your means.

If you find yourself nodding your head yes to any of these signs, it might be time to make a change with your finances.

What is the Defintion of Living Beyond Your Means?

Simply put, living beyond your means is spending less money than you make.

So if you make $4000 per month and only spend $3000, you have $1000 left to save, invest, or pay down debt with.

If you spend all $4000 every month, you would be living right at your means since you are spending everything that comes in.

However, if you spend $4500 per month even though you make $4000, you would be living well beyond your means. You would have to get the $500 difference from your savings, a credit card, or a friend/family member.

The reason why living beyond your means is so dangerous is that it leaves you in a very vulnerable position financially. You can’t save any money (and you probably don’t have much or anything saved), put money toward retirement, or pay down debt.

There is no breathing room in your budget for unexpected expenses.

And if you lose your job or have an emergency, you’re left scrambling. And it probably means more debt and more stress.

10 Signs That You Are Living Beyond Your Means

A report by Lending Club found that 33.5 million Americans spent more money than they made in the last 6 months.

I would bet that most or all of those people would exhibit at least a few of these signs!

If you’re unsure if you are living beyond your means, here are 10 clear signs.

1. Your Credit Card Balance is Growing

The biggest sign that you are living beyond your means is that your credit card debt balance is growing. Like I mentioned above, if you’re spending more than you make each month, you have to get the difference in income from somewhere.

Credit cards can make it far too easy to live beyond our means. It’s so easy to swipe the card for everything we want, without thinking about the implications on our budget.

Plus, credit card interest rates will crush you financially. Paying 20% interest on stuff you bought months or years ago is just insane!

If you struggle with credit card debt, I highly recommend to stop using credit cards. Force yourself to save up cash for things you want instead of swiping the card and wondering why you can’t get ahead.

Saving up cash instead of relying on credit cards will help you live within your means, because you can only buy things with money that you actually have.

And if you do choose to use credit cards, make sure you pay off the balance in full every month and are not tempted to overspend.

2. Your Housing Payment is Greater than 28% of Your Take Home Pay

Your rent or mortgage payment is likely your largest monthly expense, so it’s important to do this within your means.

A good rule of thumb to avoid living beyond your means is to have your house payment (rent or mortage, including taxes and insurance) be less than 25% of your total household post-tax income. Even better if you can spend less than this!

Once you start spending much more than 25 – 28% of net income on housing, it’s easy to feel house poor. If half of your income goes to rent every month, there isn’t much left over for bills, savings, and fun!

Being house poor makes it really easy to live beyond your means just to get by.

3. Your Car Payment is More Than Your Monthly 401k Contribution

Your second-highest monthly expense is probably transportation. Car payments, gas, insurance, and maintenance costs can add up quick!

Americans get freaking buckwild with their car payments and it blows my mind (those viral Tik Tok videos of the guy at the car dealership asking everyone what their car payments were and everyone was like $700+?).

Like, is driving a huge SUV or truck that important to you that you’re okay with sacrificing your future just to look cool in the parking lot?

A telltale sign that you’re spending too much on your car is to compare your monthly 401k contribution with your car payment. Is your car payment more than you’re putting into savings and investments each month?

If the answer is yes, you’re hustling backwards (and likely living beyond your means as well).

You guys know that I’m not a huge fan of car payments, but if you must finance a car, make sure you follow the 20/4/10 rule. Make sure you put down at least 20%, finance for no longer than 4 years, and make sure the payment is less than 10% of your monthly income.

Housing and transportation are the two largest monthly expenses for most people, so make sure you do both of these things right.

You don’t want to be house and car rich, but life poor! If most of your income goes to your car payment and mortgage, you won’t have any money left to have fun or save.

We all need to live somewhere and have reliable transportation, but that does not mean we need a 4000 square foot dream home as our first house and a $60,000 beamer as fresh college grad.

4. You Frequently Use “Buy Now, Pay Later Services”

Buy now, pay later services like Klarna, Afterpay, and Affirm try to trick you into thinking that splitting your purchase up into 4 easy payments is a good way to budget. After all, $25/month sounds a lot more palatable than $100 right?

Let’s get one thing straight: there is nothing easy or convenient about these services. It’s debt.

Similar to credit cards, buy now, pay later services encourage you to buy things that you otherwise wouldn’t or couldn’t afford because you wouldn’t or couldn’t spend the cash to cover the entire cost at once.

And what to do we call spending money that you don’t have? Living beyond your means.

They try to sell you on a “0% loan” to help you “afford things you want,” but you get hit with late fees if you don’t pay on time, up to 25% of the balance owed (which is in the ballpark of credit card interest rates).

I know some people will come at me with “but you only get charged with late fees if you don’t pay on time and I would never miss a payment!” And maybe you wouldn’t, but 42% of Americans who have taken out one of these loans has missed at least one payment.

The numbers don’t lie.

Please avoid these buy now, pay later debt traps and save up cash for the things you want instead.

5. You Charge Purchases to a Credit Card When You Don’t Have the Cash

I think credit cards are a great tool if used responsibly, but they can also be a sneaky trap to get you to live above your means.

It’s so easy to swipe a card (or tap, or use ApplePay, or “buy now” on Amazon), that we don’t always think about what happens when the bill comes due.

“Eh, I get paid next Friday so I’ll just charge it now and worry about it later.” Meanwhile, you forget about other bills, groceries, and that you also need to put gas in your car.

So when pay day finally rolls around, there’s nothing left to pay off the credit card bill!

If you find yourself swiping the credit card and then scrambling to figure out how to pay it off each month, you might be living beyond your means. When using a credit card, always always always have a budget and make sure your purchase is within it!

6. You Have Nothing in Savings

Another clear sign that you are living beyond your means is if you have absolutely nothing in savings.

You either spend every dollar that comes in and have never had a chance to save any money, or you’ve been using your savings to bridge the gap between what comes in and goes out.

Having no money in savings should send the alarm bells ringing in your head. You’re one emergency away from significant credit card debt and financial distress.

Start tracking your spending, cutting way back on unncessesary purchases, and selling stuff you don’t need in order to build your savings. This is the foundation to a successful financial future.

Related: How Big Should Your Emergency Fund Be?

7. You Feel Stuck in a Paycheck to Paycheck Cycle

Another sign that you’re living beyond your means is if you feel stuck in the paycheck to paycheck cycle. You rarely have money left over after each paycheck to save.

And living paycheck to paycheck isn’t just the reality for low-income folks. CNBC found that 36% of people making over $100,000 per year were living paycheck to paycheck, too.

My great-grandpa always said, “it’s not what you make, it’s what you spend.”

And he’s right! Someone making $60,000 per year but saving $10,000 of that is way more impressive than someone making $150,000 and saving nothing.

If you’re living paycheck to paycheck, that means you have to put a stop to the spending and/or figure out a way to increase your income.

8. You Tend to Shop When You’re Upset or Bored

I know I’m guilty of this, but how many times have you opened a tab to online shop or make a “quick” Target run just to browse when you get bored?

While shopping in and of itself isn’t a bad thing, it can lead to a slippery slope of living beyond our means. Online shopping, social media, and tap to pay have made it incredibly easy to spend money in seconds these days.

And the rise of influencers on social media can trigger these feelings of inadequacy even more. Now we’re not just keeping up with the Joneses in our own neighborhoods, we’re keeping up with the Joneses 8 states away!

You know yourself best: what do you do when you get bored or are upset?

Understanding your habits will help you create systems to manage those emotions more effectively than impluse buying random crap on Amazon.

I’ve found that implementing a 24-hour rule for impluse purchases helps a lot. Just giving yourself that buffer period to think about it for awhile before making the purchase can curb that unncessary spending.

Plus, I often forget about the purchase after a day anyway!

9. You Make Good Money But Have Nothing to Show for It

Another sign that you may be living above your means is if you make good money but have nothing to show for it.

You feel like you’re on a perpetual hamster wheel. Working hard, getting paid, and wondering where your money went and why you don’t feel like you’re making progress financially.

Starting a budget and tracking your spending can help immensely with this. See where your money is actually going and decide if you want to make changes.

You’ll feel so much better when you make a plan for your money instead of wondering where it went and why you can’t seem to save anything despite earning a good salary.

Related: How to Make a Zero Based Budget (With an Example!)

10. You Feel Stressed About Your Financial Situation

And finally, simply feeling stressed about your finances can indicate that you’re living beyond your means.

If you’re living well below your means, saving money, and making progress on your financial goals, why would you feel stressed?

Simply being worried about your financial situation might not always mean that you’re living above your means, but it might be an indicator. If you do feel stressed, ask yourself if that stress is valid.

Do you have a stable job? Are you consistently saving money each month? Do you have a general idea of where your money is going? If the answer to most of these questions is no, then you might be living above your means and need to make a change.

How To Stop Living Above Your Means

If you read through this list and have decided that you may be living beyond your means, here are a few things to do to get on track with your finances:

- Create a budget. I know, budgets get a bad rap for being restrictive, but they’re really just a plan for your money. Make sure you know exactly where every dollar is going. Record every purchase you make and check in with your budget frequently to prevent overspending. I personally use this budget template in Excel/Google Sheets!

- Pause unnessesary spending. Start meal prepping, unsubscribing from store email lists, and figure out a way to cut costs wherever you can. Remember that living super-frugally doesn’t have to last forever! Figure out your cash flow and raise your income over time to add some of those “wants” back in the budget.

- Cut. Up. Your. Credit. Cards. Again, this might just be for a season, but stop using your credit cards if you’re tempted to overspend and if you have credit card debt.

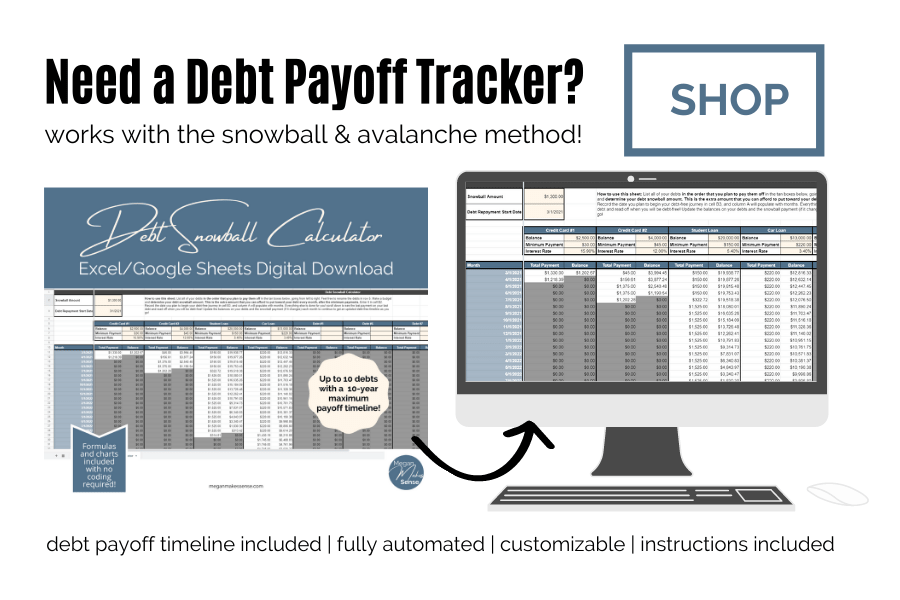

- If you have credit card debt, go scorched earth and throw every extra dollar you have toward paying that off. Get a second job, drive Uber, start walking dogs, etc if you need to. Choose a debt payoff strategy and go all in! Credit card interest rates will eat you alive, so do everything you can to get out and stay out of consumer debt.

- Make sure you’re not spending too much on your largest monthly expenses (housing, car, food). Cutting out a $5 coffee is great, but if you can get a roommate and save $800/month, that will make way more impact. Check out this blog post on 3 personal finance rules of thumb to help you live below your means.

I know it’s normal in our society to always be broke, have debt, and joke about how we can’t afford anything. But the reality is that only you can control your financial situation.

It doesn’t have to be like this. Eventually, the stress of living above your means will get to you.

Do you want to wake up 30 years from now and wonder where all your money went, why you can’t afford to retire, or why you still feel so broke after working for decades?

You can stop living beyond your means, save money, and get ahead financially. I know it’s not the popular thing to forgo the new car, bigger house, and designer clothes, but financial freedom is so worth it.

You’ll have so many more options in the future while your friends are working 40-50 hours a week just to keep up with the Joneses.

-Megan

This post was all about 10 ways you’re living beyond your means and what to do about it.

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: How to Save Your First $100k - Megan Makes Sense