Have you ever sat down and thought about how you view your money? Do you think money is evil, or that it’s bad to want more of it?

Or maybe you see it as a means of consumption: more money equals a bigger home, a nicer car, and lavish vacations, right?

Means of consumption is how I used to view money. I knew the number in my bank account and price of things I wanted to buy, and if the former number was larger than the latter, I could “afford” said item.

That is, until I really learned and applied a simple middle school algebra concept to my personal finances: the power of compound interest.

Understanding compound interest and how it applies to investing and wealth-building changed my life. Literally.

I started to see money as tool to help me live the life I want along with giving me more options and control over my future. Putting my army of dollars to work inside of my retirement accounts until they could eventually earn enough money to replace my income, completely passively, blew my mind.

I went from an “I need a brand new car to prove how successful I am as an entry-level engineer” mindset to an “I’m going to dump as much money as I can into my 401k and Roth IRA so I don’t have to work a 9-5 forever” mindset.

I went from a consumer mindset to a wealth-builder mindset.

Building wealth for financial freedom and being able to retire comfortably all centers around one key principle: the power of compound interest.

Pivoting from a mindset of “I want money so I can buy things” to one of “I want money so I can buy my time back and have full control over my life” will help you get there.

So let’s chat about compound interest, how it applies to your finances, and how to shift from a consumption & spending mindset to a wealth building one.

This post will also explain how you can take advantage of compound interest to build wealth and retire a millionaire, without much effort!

This post may contain affiliate links, which means I get a small commission should you choose to purchase or sign up through one of my links, at no extra cost to you. I only recommend products that I personally use and believe in. You can read more about this in my disclaimer.

What is Compound Interest?

Let’s go back to middle school algebra for a second (hang in there, we’re getting to the good stuff soon!).

You may remember a lesson about compound interest.

Compound interest is interest earned on the principle of an investment AND the previous accrued interest. In other words, your interest earns you MORE interest.

It works like this:

Let’s say you deposit $1000 into a savings account that pays you 2% interest each year. After 1 year, you now have $1020. Pretty simple right?

In year 2, the interest accrued on your savings account takes your initial $1000 balance AND the $20 of interest earned last year as well. So by the end of year 2, you’ll have $1040.40. A whole $0.40 more than the first year!

Okay, so maybe the first two years aren’t that exciting. But how does compound interest work if you leave the money alone for a longer period of time?

After 10 years, you’ll have $1218.99, after 15 years you’ll have $1345.87, and after 20 years you’ll have $1485.95.

See how the line isn’t perfectly linear? That’s compound interest working!

Where it gets really exciting is if you contribute more of your own money to the account and can achieve a higher rate of return.

Where can you get a higher rate of return, you may ask? Let’s talk about the stock market!

How Compound Interest Works With the Stock Market

You might have heard that the “stock market returns an average of 10% per year.” Which is true, but that doesn’t mean that it ALWAYS goes up 10% every single year like clockwork.

That number is an annualized average rate of return over the past 100 years or so.

So if you take the rate of return for each year divided by the number of years, you have just annualized the rate of return.

For example, the S&P 500 (stock market index that includes the largest 500 companies in the United States) has returned 26.89%, 16.26%, 28.88%, and -6.24% over the last 4 years, respectively.

If you want to annualize that return over the same period, add up the individual yearly returns and divide by 4. You get a 16.45% annualized return over the last 4 years.

Do that same math equation over the last 100 years, and you get around 10%. You can check my math on this website to see what the historical rate of return of the S&P 500 was over the last century!

So how do annualized returns relate to compound interest and wealth building?

The annualized rate of return gives us long-term investors a way to predict the future value of our investments.

So while you may see a totally different rate of return in the next year or two, stay invested long enough and that 10% rate of return gives us a pretty reliable way to predict the value of our money decades into the future.

Why Compound Interest is So Powerful

This is where the power of compound interest gets fun.

So we know that in the long-term, the stock market has gone up an average of 10% per year, annualized. All you have to do is consistently put your money to work in the stock market and be patient.

Easier said than done, right?

Once your investments reach a certain point, they can totally replace your income! Meaning, you are no longer dependent on an employer’s paycheck and you are free to choose how to spend your days.

So how much do you need and how long will it take?

To solve the first question, let’s talk about the 4% rule.

The 4% rule says that you can safely withdraw 4% of your investment balance each year, give yourself a raise for inflation as cost of living goes up, and never run out of money.

If you do some back of the napkin math, you’ll need approximately 25x your yearly expenses saved in order to retire comfortably.

Again, this is just an estimate, but it’s a great goal to start with if you want to retire someday (whether that’s early retirement or traditional retirement).

Most people will need AT LEAST $1 million. Each $1 million invested will generate approximately $40,000 per year in annual income.

But Megan, $1 million is a ton of money! There’s no way I could ever amass that amount on an average salary!

I know that $1 million sounds like a ton of money (and it totally is, don’t get me wrong!), but it is totally attainable in the long term with consistent contributions to retirement and investment accounts. Even on an average salary.

Now, answering the “how long will it take?” question:

Figuring out when you’ll hit your “financial independence number” (25x your yearly expenses) is a function of rate of return, monthly contribution amounts, and the compound interest formula.

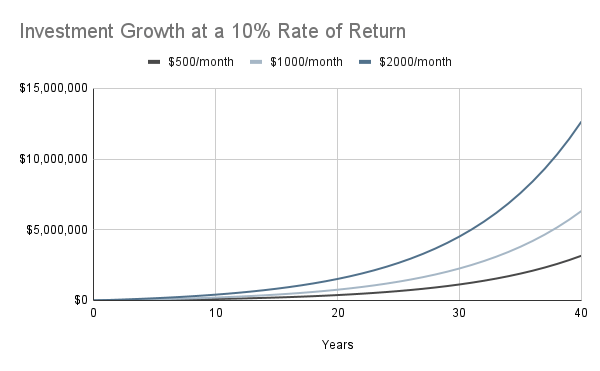

Using a 10% rate of return, and assuming you invest $500 per month, you’ll hit $1 million in about 30 years.

Want to retire sooner than that? Invest more money!

Contributing $1000 per month will get you to $1 million in about 23 years. $2000 per month will get you there in about 17 years.

See what happens around the 30-year mark? Compound interest takes off, and you’ll likely see yearly investment gains larger than your annual contributions!

If you’re curious about how I got those numbers, check out this compound interest calculator. Plug in your starting balance (I used 0 for these examples), a 10% rate of return compounded annually, and your monthly contribution and see what your money will be worth in the future!

And that is the power of compound interest, baby.

How Compound Interest Changed the Way I View Money

Once I learned about the power of compound interest, my whole mindset around money changed.

It also helped that was starting my first “real” job out of college. Turns out, sitting at a desk for 40 hours a week wasn’t as exciting as I thought it would be.

Waking up super early because I had to leave before 7 am to beat traffic, working all day, commuting an hour to the gym to work out at the absolute busiest time, and then finally getting home at 6:30 to shower and make dinner and then go to bed.

And then do it all over again for 4 more days before finally getting to the weekend to “live it up” or be incredibly lazy because all of my mental energy was drained from the week and I had to rest up quickly to get ready to do again.

And again. And again.

For 40 years, right? Because this was what adults do, right? So I better get used to it.

Learning how to live below my means, pay off my student loan debt, and beginning to invest the money I was saving fueled a fire in me to reach financial independence much sooner than age 65. I don’t want to work a 9-5 forever!

I started seeing money as a tool to give me options in the future instead of as a means to buy more “stuff” to prove how “successful” I was.

I want financial freedom and security so much more than a new car or a huge house.

Having money saved and invested means that you can leave a toxic job and take your time to find the right opportunity because you’re not living paycheck to paycheck.

Making some sacrifices in your 20’s so that you can afford to max out your Roth IRA each year because you know that contributing $500 per month from ages 22-30 will turn into almost $2 million at age 65 even if you quit investing for the rest of your life.

Knowing that you don’t have to climb the corporate ladder to make a ton of money in exchange for more time and responsibility because you don’t need that salary bump to afford your expenses (although the opportunity is always there if you want it!)

The key is identifying what you truly want from life and putting together a plan to make it happen.

Going through this mindset shift helped me intentionally allocate my spending in a way that maximized my happiness.

I found that not spending much on clothes and lunches out allowed me to spend more on weekend trips with friends. Not having a car payment allowed me room in my budget to contribute to my Roth IRA and take advantage of compound interest.

I wasn’t less happy because I was spending less. In fact, I found more happiness because each dollar I spent had a higher “return on happiness” because I knew what was worth it and what wasn’t.

Now don’t get me wrong, I do buy clothes and go to lunch sometimes!

Where it gets dangerous is if you make a habit of spending money and don’t evaluate if it’s really worth it to you.

What’s worth it to you likely looks different that what’s worth it to me. And that’s cool!

A nice, quality home, spending money on travel and experiences, being generous, and dumping a large portion of our income into our retirement and investment accounts is where I get the highest return of happiness per dollar spent.

And that my friends, is how compound interest changed the way I view money.

How to Take Advantage of Compound Interest

Now you might be wondering how to take advantage of compound interest.

The answer is simple, but not easy. Spend less than you make and invest the difference.

In order to create this gap between your income and expenses, you’ll have cut expenses or increase your income.

Pay off your debt to free up cash flow so that you can invest. Keep housing and transportation costs in check (these 2 areas are where people lose their minds and way overspend).

Once you’ve got a handle on your monthly expenses and have freed up money to invest, increase your 401k contribution at work, open a Roth IRA, and buy low-cost index funds.

If you’re looking for a one-stop shop to learn everything about investing, I highly recommend Personal Finance Club’s Index Fund Investing course. You’ll learn everything about compound interest, which accounts to open, how they’re taxed, and how to choose which funds to invest in!

As you earn more over time, continue increasing your investment contributions!

You’ll be well on your way to retiring a millionaire.

Read Next:

- 3 Actionable Personal Finance Rules to Help You Live Below Your Means

- The Complete Beginner’s Guide to Saving for Retirement

- Roth IRA 101: A Complete Guide to Investing for Beginners

- How to Save Your First $100k

- 6 Proven Strategies to Avoid Lifestyle Inflation

-Megan

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: 7 Limiting Beliefs About Money That are Preventing You From Building Wealth - Megan Makes Sense

Pingback: How to Save Your First $100k - Megan Makes Sense

Pingback: Here's Exactly What To Do With Your First Paycheck at a New Job - Megan Makes Sense

Pingback: 5 Signs You're Ready to Start Investing - Megan Makes Sense

Pingback: Are Car Payments Bad? 5 Ways Your Car Payment is Keeping You Broke - Megan Makes Sense

Pingback: How to Stop Impulse Buying Crap You Don't Need (And Actually Save Money!) - Megan Makes Sense