Today we are talking all about budgeting! The sexiest personal finance topic, I know.

You have to know where your money goes if you want to build wealth. It is the most critical first step.

Creating a zero based budget spreadsheet was the first step I took when figuring out how to manage my money effectively. I wouldn’t have been able to create a debt-payoff plan, cut expenses, or know what to do with any extra money if I didn’t build a habit of budgeting first.

Budgeting is like working out and eating a healthy diet.

It’s not new, exciting, or sexy.

It doesn’t have to be perfect (and it probably won’t ever be!), but the small, consistent actions compound over time and give you those exciting results as you achieve your goals.

For me, I found a monthly, zero based budget to be the most effective. It worked really well when I was single, in my first entry-level job, and was working on paying off my mountain of student loans.

And it still works great now, even though I’m married, debt-free, and a homeowner!

I think it is super important to know where every single dollar you make goes, especially if you’re just starting out with budgeting.

Once you see where your money is currently going, you can make changes if necessary.

Because a zero based budget (or any budget) is really just a spending plan. It gives you control over your finances and puts you in the driver’s seat of your financial future.

And your budget should be empowering, not restrictive. If you feel restricted, it’s time to make some adjustments!

This post is all about how to create your own zero based budgeting system, with an example to help you get started.

And if you want to cut to the chase and get started, grab a copy of my zero based budget template here! This is what I personally use every single month to create my budget and track my spending.

What is a Zero Based Budget?

A zero based budget is a way of budgeting so that money in – money out = zero.

Every dollar coming in should have a place. Whether that’s expenses, savings, debt payoff, or investments.

It’s a common misconception that money in – money out = zero means that you’re spending every dollar, which isn’t true! Your savings and investment contributions are included as a part of the “money out” category, even though you are keeping/saving that money.

A zero based budget also does not mean that your checking account balance should ever be zero (please give yourself a buffer of 2-4 weeks’ of expenses there).

It just means that every dollar coming in that month gets allocated somewhere (so if you have a $2000 checking account buffer, and bring in $5000 per month, you’ll allocate the $5000 in your budget and not touch the $2000 buffer. But it’s there in case you go over budget, have a small unexpected expense, etc).

I love zero based budgets because they give every dollar a job. No dollar is left behind when building your army of dollar bills for the future.

It maximizes each dollar to get your money working for you.

You can make a zero based budget in a spreadsheet, app, or pen & paper. The only requirement is that money in – money out = zero.

How to Make a Zero Based Budget

Did I convince you to start budgeting yet?? Here’s the step-by-step process on how to make your own zero based budget.

1. List Your Income

The first step to making any type of budget is listing your total monthly income at the top.

Now is the time to really understand how much money you really bring in each month.

If you’re salaried, this should be pretty easy. If your income is irregular, or you’re hourly, look at your last few paystubs and estimate your monthly income.

And if you’re married, include income from both spouses. I personally believe in combining finances when you’re married, as long as you’re on the same page financially and are safe.

2. List Your Fixed Expenses

The next step in creating a zero based budget is to list out all of your monthly fixed expenses.

These are the predictable expenses that need to get paid every month, such as

- rent/mortgage payment

- utility bills

- cell phone

- subscriptions

- insurance

- childcare

- car payment

- other minimum debt payments

Make a list of all of these expenses underneath your income.

My template has a separate section for debt payments, so you can either put your minimum payments there or in the expenses section. If you put them in the expenses section, you can use the debt section to track your extra debt payments.

3. Create Categories for Variable Expenses

Once you have your fixed expenses listed, it’s time to assign categories to your variable expenses.

Variable expenses can be wants or needs. It’s important to have an idea of what you plan to spend in each of these categories throughout the month.

Some budget categories to get you started could be:

- gas

- groceries

- restaurants & entertainment

- travel

- shopping

These categories may fluctuate every month and are a bit trickier to predict. If you’re starting from zero, I would recommend printing out the last 3 months of your credit card and bank statements, adding up what you spent in each category, and dividing by 3 to get a rough average.

Remember, a budget doesn’t have to be perfect! So give yourself some grace if your discretionary spending is higher than you would like.

Getting a realistic picture of where you are now will help you make changes for the future. You cannot plan for the future if you don’t know where you’re starting.

4. Include Savings, Investment Contributions, & Extra Debt Payments

Now that you have your income and expenses figured out, subtract the latter from the former.

How much money do you have leftover after spending each month?

This income can be allocated to your financial goals, such as saving up a 3-month emergency fund, contributing to your Roth IRA, or paying off your car loan.

Depending on the income you listed at the top, your 401k contribution and other payroll deductions might not be included (basically, if you use your net pay for the income section where your 401k contribution has already been taken out, don’t double-count your 401k contributions here unless you add them back in to your income).

My template has sections for each of these goals.

Check out this post if you want some more ideas about financial goals to pursue!

And finally, check the last table at the bottom of the sheet to make sure any leftover money is equal to zero! This is how you’ll know if you made a true zero based budget or not.

5. Track Your Spending

This is where things get real. Writing down a hypothetical budget is NOT budgeting.

You need to track your spending to make sure you’re on track with your budget. Each week, I sit down and input all of our transactions into my spending tracker included in my budget template.

I can see how much budgeted money I have left in categories such as groceries, gas, and restaurants. If it looks like we will be going over budget in one category, I can make adjustments beforehand to stay on top of it.

If this is your first time tracking your spending, I recommend updating your spending tracker after every purchase. Yes, this may be cumbersome at first, but once you get the hang of things, you won’t have to check in as frequently.

You can also track your spending with an app. I think budgeting apps are great for more experienced budgeters, but physically writing down your spending in each category or inputting it into a spreadsheet forces you to really understand your spending habits.

Which is really beneficial if you’re just starting out with budgeting.

6. Remain Flexible and Adjust As Needed

Do not expect your first few months budgeting to go perfectly! It almost never happens that way.

Keep moving forward and making adjustments along the way. It’s okay to increase the amount in your grocery category (thanks, inflation) and for your January budget to look different than your July budget.

You can add or delete categories at any time.

On track to overspend on eating out? Decrease your shopping category this month to compensate for it.

Go over budget one month? Right click on the tab, choose “duplicate,” and make a new budget for the next month.

Have money left over at the end of the month? Apply it toward your current financial goals!

Zero Based Budgeting Example

I am a visual learner, so I thought I’d include an example of exactly how I do zero based budgeting. All of these screenshots are taken directly from my zero based budget template (I’ve changed the numbers for privacy).

First, I input our salaries at the top. My husband and I both have W2, salaried jobs. I get paid twice monthly, and he gets paid biweekly.

My monthly income is always the same, but my husband gets 3 paychecks during 2 months of the year. When this happens, I just add another paycheck’s worth of income to his line in the budget.

Next, I list all of our expenses in the yellow section. The budgeted column is where I make the budget, and the actual column pulls in data from the expense tracker to the right.

As we go through the month, I update the expense tracker and monitor our progress in each category.

The next section is the savings section to track our short-term savings goals (sinking funds- you can read more about them here!) that I include here.

The template will calculate the balance on each account and sum the total amount in the last row.

This can be kind of confusing because we often spend money out of our sinking funds each month.

There is a set contribution that I include in the budgeted column, I’ll record what I spend from each fund in the “spent” column, and then the sheet will calculate the balance based on how much I contributed, how much was spent, and the original balance that rolled over from last month.

It totals all savings line items in the last row. Since I just have one savings account for all of these funds, I “settle up” with our sinking funds at the end of the month.

So if I planned to contribute $500 toward sinking funds, but spent $330 from sinking funds that month, I would transfer $170 to the account at the end of the month.

On the flip side, if I spent $700 from sinking funds (assuming the previous balance was large enough), I would transfer $200 from the sinking fund account to our checking account to pay for whatever I used the sinking fund to buy.

I have a debt section as well, but our only debt is our mortgage so I don’t use this section anymore. You can track your extra debt payments here!

And finally, my favorite section is the investments section! This is where I track contributions to our 401ks, Roth IRA’s, HSA, and our joint brokerage account.

The 401k and HSA contributions come out of our paychecks, but I simply add the contributions back into our income and “subtract” them back out here. This is totally optional- I just personally like tracking how much we have cumulatively contributed to all of our retirement accounts!

In this example, this person contributes $450 per month to their 401k and maxes out their Roth IRA at $500 per month. The leftover $240 goes to pay extra on their car loan (the minimum payment was accounted for in the expenses section, so this is an additional monthly payment).

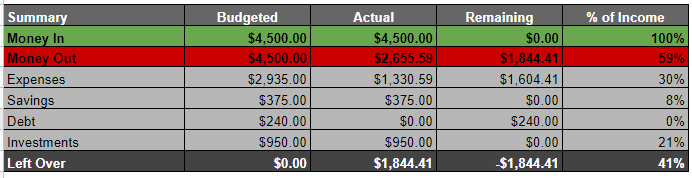

And finally, the very last section of the zero based budget template shows a high level summary of money in – money out.

The “leftover” row will be negative if you have gone over your total budget (money out is greater than money in) or positive if you have money leftover to allocate somewhere (money in is greater than money out).

In this example, the budgeted leftover row says $0, so you’re good to go! If it was not zero, you would go back and make adjustments until it did equal zero.

The “actual” column leftover row is not zero because I haven’t added the entire months’ spending into the expense tracker. As you record transactions, this amount will auto calculate.

At the end of the month, I “settle up” with the budget and make sure this line is zero as well.

And that’s the step by step process of exactly how we use a zero based budget to accomplish our financial goals!

(And if you want this exact template, click here to grab it!).

Zero Based Budgeting Advantages and Disadvantages

As with anything, there are some advantages and disadvantages of zero based budgeting. One of the main advantages is that you get a great insight into your spending habits.

Since you’re tracking every single dollar, you’ll have a lot of good data over time to make decisions from. You know exactly how much you’ve spent on groceries, travel, rent, etc.

And having that data will help you make better decisions for the future!

A zero based budget is also super flexible. There’s rarely a month that goes by where I don’t change anything in the budget. Want to add more to one category? Simply find the money from a different category and allocate accordingly.

One of the main disadvantages to this method of budgeting is that it can be time consuming. Athough I will say that it doesn’t take me more than 15 minutes a week to check in with my budget and/or duplicate the tab to make next months’ budget.

But choosing to use a spreadsheet or manually track your spending will take longer than passively looking at an app connected to your bank account.

If you have too many categories in your budget, it can also be easy to get overwhelmed and quit altogether. If this is you, have less categories!

You literally could have a bucket for “needs,” “wants,” and “savings,” make it equal to zero at the bottom, and still have a good zero based budget.

(I wouldn’t recommend this at first until you really understand how much you spend in various categories and feel good about it.)

Zero Based Budget Template

If you’re not up for making your own zero based budgeting template, there are a ton of options out there that have most of the work done for you.

I know I’m biased, but I truly believe that my Excel/Google Sheets template is one of the best out there. It has budget categories already laid out for you, an expense tracker to help you track your spending, and comes with instructions so you can use it even if you’re not a spreadsheet person!

And it’s fully customizable to your situation as well.

However you choose to budget, I hope you realize that it’s not about cutting everything fun out of your life in the name of being good with money. This is a lie!

A budget gives you the permission to spend while allow allowing you to work on financial goals at the same time.

Because you can do both!

-Megan

This post was all about how to make a zero based budget.

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Hi Megan, I noticed in your spending examples you use both your checking account and credit card. How do you determine which purchases to put on your credit card and what’s your approach to paying your card off/ building your credit? I just paid off all my debt but still want to build my credit for future asset planning. Thanks!

Hey Melanie! We put almost all of our spending on 1 credit card and I record the purchases in my template. Every payday we pay the balance off. There are a few bills we can’t use a CC for, so those come directly out of our checking account. We keep a buffer in our checking account as well so the auto pay transactions are never an issue. Everything gets recorded in the template. Hope that helps!!

Pingback: 7 Limiting Beliefs About Money That are Preventing You From Building Wealth - Megan Makes Sense

Pingback: How to Save Your First $100k - Megan Makes Sense

Pingback: How to Set Financial Goals for the New Year in 6 Easy Steps - Megan Makes Sense

Pingback: 10 Warning Signs That You Are Living Beyond Your Means - Megan Makes Sense

Pingback: Combining Finances After Marriage: A Complete Guide & Checklist - Megan Makes Sense

Pingback: The Enormous Impact of 401k Matching Contributions at Retirement (Did Someone Say Free Money?!) - Megan Makes Sense