Are you wondering how to save your first $100k?

Saving $100k seems to be the “magic” number to hit in the personal finance world.

When you think of saving $100,000, you probably picture those sweet six-figures sitting in a savings account.

However, when someone refers to “their first $100k,” that number usually means a combination of their savings and investments.

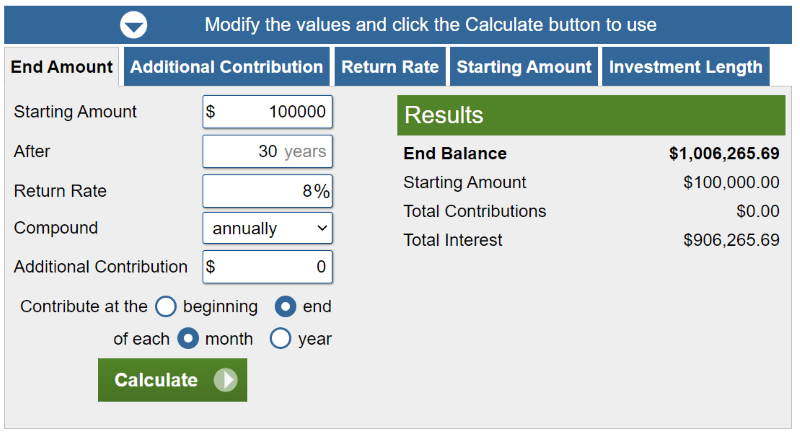

Having six figures in an investment account is the inflection point where compound interest starts to really take off. This is where investing really starts to get fun!

Think about it. A 10% annual return on $1000 is only $100. A 10% annual return on $100,000 is $10,000.

See the difference?

The more money you have invested, the more passive income gets generated each year.

Of course, you have to save your first $1000 before you save your first $100,000. So don’t get discouraged!

Saving that first $100k is the hardest and will take you the longest amount of time because most of that money will come from your pocket since compound interest hasn’t taken off yet.

But the next $100,000 is a heck of a lot easier because compound interest starts to do some of the heavy lifting for you.

At some point, compound interest will outpace your yearly contributions! Your money will literally grow faster than you can save it!

Another cool part? If you can save $100k before you turn 30, you’ll be a millionaire at age 60 without contributing another penny!

We’re talking all about how to save your first $100k in this article. You’ll understand why it’s so important along with practical steps to get there.

What Does It Mean to Save $100k?

Let’s back up a bit and talk about what it actually means to have $100,000 in savings.

Did you know that a $100k net worth, $100k in savings, and $100k invested all mean different things?

- $100k net worth: The value of all your assets (cash, retirement accounts, home, cars, etc) minus all of your debts is greater than or equal to $100,000

- $100k in savings: The value of your savings, investment, and retirement accounts is greater than or equal to $100,000

- $100k invested: The value of your investments and retirement accounts is greater than or equal to $100,000

So why is this important?

A $100,000 net worth is drastically different than $100,000 invested.

Your net worth takes things like the equity in your home, the value of your cars, and how much debt you have into account.

$100,000 invested is simply $100,000 invested. It doesn’t take the value of your home or your debt into account.

You could have $100,000 invested and still be drowning in credit card debt! (Although I would recommend paying off your credit card debt before going crazy investing your money).

The value of your home and cars won’t do anything to make you passive income in retirement. Which is why it’s important to distinguish between a $100,000 net worth and $100,000 in investments.

Someone could own a million dollar home and have nothing invested to produce income in retirement. This person would be broke even though they live in a million dollar home!

A big home and nice cars DO NOT automatically equal wealth.

For the purpose of this post, let’s define “your first $100k” as the total balance of all of your investment accounts, such as your 401k, 403b, Roth IRA, HSA, etc.

You’ll most likely hit a $100k net worth before you hit $100k in savings and investments. Remember to celebrate all of those milestones along the way as you build wealth!

$100k net worth is still a huge accomplishment!

Related: How to Track Your Net Worth: What It Is and Why It Matters

This post may contain affiliate links, which means I get a small commission should you choose to purchase or sign up through one of my links, at no extra cost to you. I only recommend products that I personally use and believe in. You can read more about this in my disclaimer.

Why the First $100k is the Hardest

Getting your first $100k invested is a huge accomplishment that requires planning and sacrifice.

Once you get the first $100,000 invested, the next $100,000 is much easier to save because of compound interest (compound interest should seriously be the 7th wonder of the world).

The reason your first $100k is so important is because it is the hardest.

Since you don’t have a huge nest egg (yet), compound interest hasn’t had a chance to really get going. Therefore, most of the money in your first $100k will be your own. And it’s not easy to save and invest that money when there are so many temptations to spend it instead!

The next $100k is infinitely easier. And the one after that is even easier.

You’ll soon have a compound interest snowball so big that it is growing faster than you can add to it!

$100k is also the threshold that means you’ll retire a millionaire in 30 years, even if you don’t contribute another penny!

If you can save $100,000 before age 35, that means you’ll retire a millionaire at 65 without contributing another penny to your investments!

You will now have the option to ease up a bit on your retirement savings, spending more on wants, or start investing in other things.

Or maybe you want to keep your foot on the gas and continue saving to retire early! Having your first $100k saved gives you more options and control over your future.

I highly recommend making saving and investing a huge priority, especially if you haven’t saved your first $100k yet.

A few years of delayed gratification and sacrifice means you can secure your entire retirement income. Isn’t that incredible??

How to Save Your First $100k

Here are my best tips to show you how to save your first $100k.

I personally did all of these things and was able to save my first $100k in about 3 years, despite graduating with $56,000 of student loan debt!

1. Get on a Solid Budget

The first step to saving $100k is to understand your monthly cash flow and get on a solid budget.

How much money do you bring in every month? How much do you need to live on? How much is left over?

It’s really hard to save money if you don’t track where it goes. Start tracking your expenses and understand how much money you can realistically save and invest each month!

My monthly budget template will help you plan where you want your money to go instead of wondering where it went.

If you don’t have much money left over, try to understand why.

Do you have too many debt payments? Is your housing payment more than 28% of your take-home pay? Do you need to focus on earning more money?

Paying off debt, negotiating a raise, and learning to live within your means can go a long way in increasing your monthly cash flow!

Related: How to Make a Zero Based Budget (With an Example!)

2. Keep Living Expenses Low

As your income grows over time, the key to building wealth and getting your first $100k saved is keeping your expenses low.

I’m not saying you have to live on a rice and beans diet and never go out or do anything fun (hint: try the 50/30/20 budget and tweak the numbers until it makes sense for you!)

But, making some temporary sacrifices until you have a decent nest egg built up is often worth it. Could you live with a roommate for another year, continue driving your paid-off car for a few more years, or cut back on eating out?

I personally believe that reducing your biggest expenses will make more of a dent than cutting out coffee and avocado toast.

Eliminating a $600 monthly car payment will go a lot further than cutting out a $4 coffee a few times a week.

Saving $700 a month on rent by getting a roommate for a year is more impactful to your budget than spending $10 on lunch with coworkers.

I wrote a blog post all about 3 personal finance rules to keep your expenses low, so give it a read if you’re looking for more ways to save on the big expenses.

The less you spend on living expenses, the more you’ll have to save and invest for that first $100k!

3. Start With Your 401k

Now that you’ve got your monthly cash flow and expenses under control, it’s time to start socking away money in tax-advantaged investment/retirement accounts.

By far the easiest and best way to start building wealth is with your employer-sponsored 401k. In most cases, your employer will also match your contributions for a portion of your salary.

DO NOT MISS OUT ON YOUR 401K MATCH. If you do, I will come find you.

Your 401k is great because not only will you be automatically investing a portion of your paycheck every month, your employer will be contributing as well!

And if you choose the pre-tax option, you’ll save money on taxes, which allows you to save and invest even more money toward your first $100k!

Even though 59% of employed Americans have access to a 401k, only 32% of them are actually contributing to one. Don’t be a part of this statistic.

I started contributing 10% of my salary to my 401k with my first paycheck and I’m so glad I did. If you’re under 50, you can contribute a maximum of $22,500 of your own money annually to your 401k.

At least contribute up to the full company match so you’re not leaving money on the table. Ideally, you’ll want to contribute 10 – 20% to your 401k.

Related: 6 Must-Know Questions to Ask About Your 401k Plan (What Beginners Really Need to Know)

4. Max Out a Roth IRA Each Year

Another amazing place to park a portion of your first $100k is in a Roth IRA.

A Roth IRA is an individual retirement account that grows tax-free! Anyone can open one as long as you have earned income and are below the income limit.

The IRS lets you contribute $6500 per year in 2023.

If you can afford to max out this account each year, I highly recommend it.

Roth IRA’s are great for young workers because you have so much time until retirement to let your money grow, and it’s all tax-free!

I recommend prioritizing your retirement investing in this order:

- Invest up to the company match in your 401k (usually 1-6% of your salary)

- Max out your Roth IRA ($6500 per year)

- Increase your 401k contributions until you can max it out ($22,500 per year)

- Invest any extra cash into a taxable brokerage account

I elaborate on this strategy more in this blog post: The Complete Beginner’s Guide to Saving for Retirement.

You want most (if not all) of your first $100k in retirement accounts. The tax benefits are too good to pass up!

Related: Roth IRA 101: A Complete Guide to Investing for Beginners

5. Watch for Lifestyle Inflation

As your income increases, it’s so easy to spend more. “I got a raise, so I should get a nicer apartment, right?”

While it’s natural to slowly increase your lifestyle over time, you’ll want to be mindful of it, especially if you’re still saving your first $100k.

Make sure you’re spending on things that actually add value to your life and not mindlessly spending on crap you don’t care about.

Next time you get a raise, commit to investing all or a portion of it. If you get a 4% raise, try upping your 401k contribution a few percentage points.

Take your bonus check and throw it in your Roth IRA or taxable brokerage account!

Having a plan for when extra money comes in will help you avoid lifestyle inflation and build wealth!

6. Track Your Progress

Tracking progress toward any goal is a great way to stay motivated.

I personally track my net worth progress in my net worth spreadsheet.

Once a month I sit down and record the balances on all of my accounts and see the progress I’ve made with my net worth!

You can check out the spreadsheet here! All of the coding is done for you, so it’s beginner-friendly and also comes with instructions.

How Long Does it Take to Save $100k?

The amount of time it takes to save your first $100k depends on a few factors. Your income, savings rate, lifestyle, and the stock market will all play a part.

It’s important to remember that this isn’t a race or competition. It’s easy to look at someone on social media, compare your life to their highlight reel, and feel discouraged.

But it is totally possible and reasonable to save your first $100k in a few years! It probably won’t take as long as you think.

Here are some rough timelines:

How to Save $100k in 2 Years

Saving $100k in 2 years is not an easy feat! However, if you have a high income and low expenses, it can be possible.

Since 2 years is such a short timeframe, we will ignore stock market growth. Assuming the full $100k would come from you (and assuming we don’t have a bear market in those 2 years), you would need to invest $50,000 per year.

Here’s how you could get there:

- Max out your 401k each year: $22,500 per year or $45,000 over 2 years (this won’t include an employer match)

- Max our your Roth IRA each year: $6500 per year or $13,000 over 2 years

Maxing out these two accounts alone will get you over halfway there! The Roth IRA and 401k will get you to $58,000 in two years, assuming no employer match and no stock market growth or loss.

And if you’re married and your spouse has access to a 401k, you can double these numbers and get to $100k just with 2 Roth IRA’s and 2 401k’s!

(For simplicity’s sake, we will assume a single person).

If you have access to a health savings account (goes along with a high-deductible health plan- blog post on how to use an HSA to build wealth for retirement here), you could max that out at $3850 per year, or $7700 over 2 years. Maxing out the HSA, Roth IRA, and 401k will get you to $65,700.

And the remaining $34,300 (or $42,000 if you don’t have an HSA) could be invested in a non-retirement, taxable brokerage account.

Badaboom, that’s how you save $100k in 2 years! You would need to invest about $4200 on average each month to hit this goal, which may not be realistic for you (it definitely wasn’t for me!).

Again, this is not a competition!

How to Save $100k in 3 Years

Saving your first $100k in 3 years also isn’t easy, but it’s a little more doable than doing it in 2 years.

You would need to invest about $33,000 per year or $2700 per month (again, we will assume no stock market growth or losses due to the short-term nature of this goal).

Here’s how you can get there:

- Max out your 401k each year: $22,500 per year or $67,500 over 3 years

- Max out your Roth IRA each year: $6500 per year or $19,500 over 3 years

- Max out your HSA each year: $3850 per year or $11,550 over 3 years

This will get you pretty dang close to $100k!

Maxing out these 3 accounts over 3 years puts you at $98,550 of contributions, so you could very well hit $100k with some stock market growth, employer match, etc.

And if you come up a bit short, you can invest the difference in a taxable brokerage account.

How to Save $100k in 5 Years

If you want to save $100k in 5 years, you’ll need to save roughly $1450 per month.

Since 5 years is more of a medium-term goal, let’s assume a 7% annualized rate of return. In order to hit $100k in 5 years with these conditions, you’d only need to save about $87,000 of your own money, thanks to compound interest!

Here’s how you could allocate that $87,000 over 5 years:

- Invest $13,500 in your 401k each year for a total of $67,500 over 5 years

- Max out your Roth IRA each year: $6500 per year or $32,500 over 5 years

And you’re there!

Saving $100,000 can seem like such an impossible goal, but if you break it down into small steps over time, you’ll get there sooner than you think.

And if you set a goal to save your first $100k in 5 years, but it ends up taking you 7, that’s still an amazing accomplishment! Don’t give up just because you didn’t hit your goal on an arbitrary timeline.

You WILL get there!

Summary: How to Save Your First $100k

Hopefully these tips got you think about how to save your first $100k and why it’s so important.

Achieving this financial milestone while you’re young basically guarantees a comfortable retirement. And then you have so much more freedom to do what you want!

Saving $100k isn’t easy and requires hard work, intentionality, and sacrifice. But the financial freedom that comes with it is so so worth it!

Getting on a budget, living below your means, and investing a large chunk of your income into tax-advantaged retirement accounts will get you your first $100k in no time!

And if you’re ready to start investing but have no idea where to start, I highly recommend Personal Finance Club’s Index Fund Investing Course. Jeremy goes over everything you need to know about the stock market, taxes, how to choose investments, types of accounts, and more! It’s reasonably priced and covers everything in 7 quick lessons.

And it only gets easier from there. If you have the discipline to save $100k, you can do anything!

Is saving your first $100k one of your financial goals? Let me know about it in the comments below!

-Megan

This post was all about how to save your first $100k.

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: 6 Smart Things to Do With Your Tax Refund This Year - Megan Makes Sense

Pingback: 5 Signs You're Ready to Start Investing - Megan Makes Sense