Like most college students, I didn’t give much thought to finances, student loan debt, or what it would actually look like to pay back my student loans post-grad.

I just assumed that my student loan debt was normal, and that it wouldn’t be much of a financial hindrance because I had a high starting salary.

I graduated college in December 2018 with $56,000 in student loan debt and a Mechanical Engineering degree.

If you’re currently drowning in student loan debt, know that you’re not alone. There are 14.9 million people between the ages of 25 and 34 that still have student loans.

And today, I’m bringing you my own personal student loan debt story.

I’ll walk you through my experience with student loans, why I decided to pay them off so early, and how I managed to do so.

I hope that this inspires you to take control of your money and make a plan to become debt-free. If I can do it, so can you!

I also wrote a guest post on my friend, Katelyn’s blog about 5 Things I Learned While Paying Off Student Loans.

My Student Loan Journey

Like I mentioned above, I graduated with a Mechanical Engineering degree in December 2018 with $56,000 of student loan debt.

$6000 of that was federal student loans and the other $50,000 was an interest-free loan to my parents.

My parents are pretty good with money, but we never explicitly talked about it growing up.

My dad was a diesel technician and worked his way up the engineering ladder to be a technical project director and my mom is a kindergarten teacher’s assistant.

My dad worked full-time as a techinician and went to school at night 4 days a week while my sister and I were babies while my mom stayed home with us. They’re both a huge inspiration to me and I’m super thankful for the support I had growing up.

My parents didn’t have the cash to put my sister and I through college (we are 18 months apart), but they wanted to help us get through school without the crazy Sallie Mae interest rates on federal student loans.

So my parents took out a home-equity loan on the house to finance our college with two rules: 1) My sister and I had to major in something marketable that would pay the bills and 2) we would pay it back interest-free after graduation.

Seems totally fair! I was 18 at the time and had knew nothing about money except the small paychecks I got from my part-time jobs throughout high school.

Fast forward to graduation, starting my first job, and creating my first budget to figure out how I was going to manage my new salary.

I started paying my student loans back in March 2019 by using my entire signing bonus to pay off the $6000 of federal student loans. Ouch, right?

After that, my parents and I agreed on a $500 per month “minimum” payment. So that’s what I did for the first 6 months of my debt-free journey.

At this point, I really started getting into personal finance.

In December 2019, I ended up relocating to Kansas City for a work rotation. This assignment came with a free apartment, car, and meal per diem.

So pretty much all of my living costs were covered and I had a much larger portion of my salary at my disposal.

I also decided that I wanted my student loans gone as soon as possible. My plan was to put as much of my salary as I could toward my loan and use this unique work situation to my advantage.

So that’s what I did.

In 2019, I had paid off $13,600 of my loan, leaving a balance of $42,400 going into 2020.

Then the pandemic happened, the stock market crashed, and I decided that it would also be a good idea to save some cash to buy a car when I returned from my rotation, since I was still driving my high school car.

I decided to use some of the cash I had saved to max out my Roth IRA in March, and then I started splitting the rest of my disposable income toward my student loan and saving for a car.

My work rotation ended in August 2020 and my loan balance was at $28,150 (I had paid off $13,250 from January – August 2020, and $29,150 total).

I also had to cash-flow a move back to Michigan and furnish my first “real” apartment without roommates (I tried to find a roommate 3 times but they all fell through).

I also got engaged in August 2020!

A lot was going on. Moving, planning a wedding, and figuring out how to pay for it all consumed most of my free time.

So I moved back to Michigan, got used to paying rent again, and resumed the “minimum” $500 payment plan for my student loan so that I could save for the wedding.

I also bought a new-to-me used car in November 2020, paid in full with the cash I had saved.

We got married in May 2021, and the balance on my student loan was $24,500.

Nick and I both feel strongly that married couples should combine finances, create one budget, and work on financial goals together. So getting rid of that student loan was the #1 priority after our wedding.

Besides getting our 401k matches, we didn’t do any extra saving or investing and we put all of our extra income to pay off my student loan as quickly as possible.

We paid off the remaining balance on September 4, 2021 and made the last payment in a brewery in Grand Rapids to celebrate!

Why I Decided to Pay Off My Student Loans Early

I came to the realization pretty quickly that my student loans were holding me back from the things I really wanted in life.

Buying a home, spending on travel guilt-free, and having more money to invest for early retirement were the most top-of-mind things.

I also hated the feeling of not knowing if I could really afford that meal out or new pair of shoes because I had debt.

My paychecks didn’t feel like my money since that money was already owed to someone else.

Plus, owing your parents money is a whole different dynamic.

They sacrificed so much to get us through school in the best financial shape as possible. I wanted to pay them back ASAP so they could finally do the things that they had sacrificed for so long.

I also realized that it would take over 8 years to pay off my loans if I continued paying only $500 a month.

What else did I want to do in the next 8 years? Would I be married, have kids, or own a home? Would this debt hold me back from achieving those goals?

I decided that yes, it would.

So I created a plan to pay it off ASAP while I was young and my expenses were low.

Living expenses in your early 20’s are probably the lowest they’ll ever be.

You can get away with having 5 roommates, driving a hoopty, and cramming 5 people into a Days Inn hotel room in order to travel cheaply. Plus, you probably don’t have kids yet, either.

So take advantage of your low expenses and use that to get ahead financially!

How I Paid Off All of My Student Loan Debt in 31 Months

I could seriously go on and on about how I paid off my student loan debt so quickly.

As I started thinking about it, I realized that it really came down to 3 major things: making good money, living below my means, and using a zero-based budget.

The gap between your income and expenses is where the real magic happens. You’re able to pay off debt faster, invest more, and reach financial independence quicker.

So that was my strategy!

I Had a Great Starting Salary

Most personal finance blogs that I see mainly focus on frugal living, saving money on groceries, and penny-pinching in order to pay off debt.

While that’s all well and good, saving $20 at the grocery store each month won’t make a dent when you’re trying to pay off a $56,000 loan.

Since I majored in engineering (an in-demand, high-paying field), my starting salary was between $70,000 and $80,000 per year. Which is a lot of money for a single 23-year-old!

I cannot ignore this fact because it was critical to paying off my student loans so quickly.

My above-average salary allowed me to live well below my means and put over half of my income toward my student loan debt each month.

I share this with you to be transparent and up-front. If I was making less money, it would have taken longer to pay off my debt.

I never want to be one of those bloggers that brags about how they paid off $80,000 of debt in 3 months because they lived below their means and budgeted. While those things are probably true, what they didn’t disclose was how they made a crap load of money from their blog and/or full-time job.

It’s a whole lot easier to live below your means when you make significantly more money than you need to live on.

I’m obviously not out here balling out like a lot of the influencers you see on social media, but my salary was the #1 reason I was able to pay off so much debt in a short amount of time.

You need to be realistic with your debt payoff goals. Paying off your student loans in 5 years is just as impressive as paying them off in 2!

Don’t let the comparison trap stop you from working toward your goal altogether.

I Lived Well Below My Means

Despite having a great salary for my age group, I was also super intentional with how I managed that salary.

While most of my peers were out leasing new cars, going to brunch every weekend, and taking out small mortgages at IKEA to furnish their first apartment, I was learning how to live below my means so that I could get rid of my student loan debt!

I recommend lowering the 3 largest expenses in your budget instead of penny-pinching. For most people, those top 3 expenses are housing, food, and transportation.

A $3 coffee or $10 Chipotle lunch here and there don’t matter a whole lot if you can save $500 per month on rent by having a roommate.

I Lived With Roommates

When I first moved to Michigan, I rented a room in a friend’s house for $700 per month. I had 2 roommates and got to live in a fun suburb of Detroit with a bunch of other young professionals.

Rent for a typical 1-bedroom apartment in a nice, safe area ran between $1200 – $1500 per month. By living with roommates, I still got to live in a nice area and save $500+ every month.

The typical rule of thumb is to keep your housing payment under 25-30% of your take-home pay.

Having roommates allowed me to keep my rent at about 15% of my take-home pay, meaning I had even more money to put toward my student loans every month.

Since I rented from a friend, I also didn’t have to furnish an entire house by myself.

I remember buying a cheap dresser from Wayfair, a nighstand from IKEA, and a rug for my bedroom. My roommate had all the kitchen stuff, living room furniture, TV, etc.

It was perfect because she had a cute house and I didn’t have to buy a ton of stuff!

I Didn’t Upgrade My Car for 2 Years

I also started my fancy, corporate job with a 15-year-old Ford Escape with 170,000 miles on it. My trusty Escape was my high school car that I got when I was 17.

Even though I was pretty sentimental about my first car and I loved it, I seriously considered upgrading soon after starting my job.

All of my friends bought new cars, so that was just the thing to do, right? I could easily fit a monthly payment into my budget and I had an employee discount for working at a major auto manufacturer.

However, what I didn’t have was CASH.

So I continued to drive my high school car until November 2020. I finally upgraded after I saved enough to purchase it in cash.

My employee discount really wasn’t that great, so I bought a used 2017 Ford Escape for about half the sticker price.

I’m so glad I decided to put off buying a car until I learned enough about personal finance to make an informed decision.

Had I bought a car back then, I would have had a $500 monthly payment and gone into more debt.

Taking on more debt when you’re trying to get out of debt doesn’t work so well!

Plus, I could use what would have been a $500 car payment toward my student loan debt instead!

I Was Mindful of Unneccesary Purchases

I will admit that I wasn’t great at avoiding impulse purchases when I first started my job. It was hard for me to say no to a night out with friends or a weekend trip.

As I got more serious about my debt-free journey, I started cutting way back on eating out and shopping.

I stopped going to the mall for entertainment.

I started meal prepping and bringing my lunch to work almost every day.

I only ate out about once a week.

I didn’t cut out everything, though! It’s important to build in little treats here and there to keep yourself motivated.

I also learned which purchases were worth it to me, and which weren’t. By cutting out Panera with coworkers every day, I was able to make room for some of those weekend trips with friends.

Do yourself a favor and build some fun into your budget, even if you’re working on paying off debt. Even if it’s just $50 or $100 a month.

You’ll learn what you actually value spending on, and what you can easily cut out!

I Used a Zero-Based Budget

Making good money and living below your means is almost pointless if you don’t have a budget and plan where you want your money to go.

A zero-based budget means that every dollar has a job. The money coming in equals the money going out (whether that’s to expenses, savings, extra debt payments, or investments).

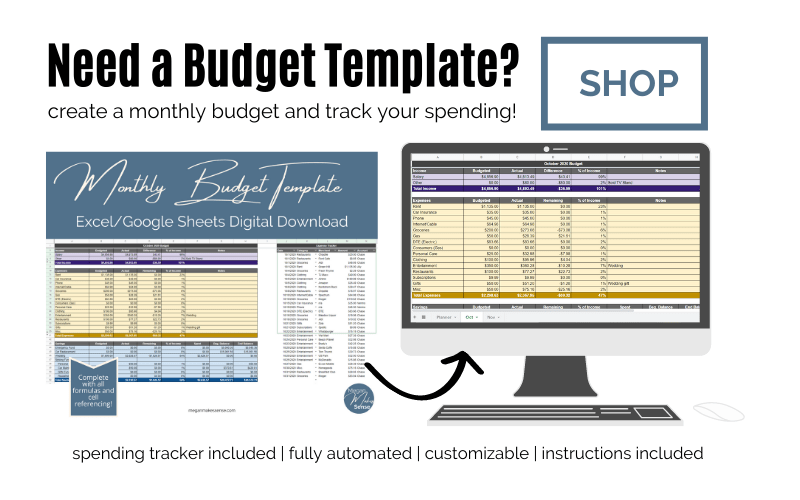

Using my Excel budget template was essential in my debt payoff journey. I listed my income and expenses and saw what was left over to pay extra on my student loan debt.

I made a budget every single month and did my best to stick to it. You can’t create a debt payoff plan unless you know how much money you bring in and how much goes out.

You can get a copy of the exact template I use here! All of the formulas are done for you and it comes pre-filled with budget categories to help you get started.

Even though my husband and I are debt-free, we still use this exact template to create our budget every month. We just don’t use the debt section anymore!

Summary

If you’re serious about paying off your student loan debt, you have to create a gap between your income and expenses in order to make extra payments.

My debt-free journey taught me a lot about what really mattered to me. When you’re focused on a a goal that requires you to make sacrifices, you will get super intentional and learn what is important to you.

I hope that sharing my story will motivate and inspire you to pay off your student loans early. The financial peace and freedom we now have feels amazing.

Each dollar we earn is ours to keep. Monthly payments are no longer robbing us of the ability to build wealth.

As you read in my story, a lot of unexpected things happened during my student loan journey. It’s important to not get discouraged and adjust your plan as life happens.

You got this!

Are you working on paying off student loan debt? What tips have helped you stay motivated along the way?

Let me know in the comments below!

-Megan

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

I love this so much! I did the same as you- when I got engaged in December 2018, I made a plan to get out of all the debt I had. I did not want any debt going into my marriage. I paid off my credit card and paid off a loan I had from my parents as well. Thankfully, my husband is the ‘nerd’ in the marriage and has really helped me along the way. There are things we want to do, travel and upgrade things at the house and such that you just can’t feel at peace doing if you’re hanging on to a lot of debt. Do y’all ever use credit cards? I’m curious! We also have a mortgage, but that’s the ONLY debt we have 🙂 I have really enjoyed following along on your journey! Thank you for sharing!

Thanks for the reply Elyse! And congrats on becoming debt-free before your wedding, that’s a huge accomplishment!! Totally agree with the peace that comes with being debt-free and having the option to travel more🙂. We do use 1 cash-back credit card and put almost all our expenses every month on it to get the points! We pay it off in full every week on payday which helps keep the balance low. Credit cards can be a great way to earn cash back or travel rewards if used responsibly and paid off in full every month. If they tempt you to overspend, don’t use them (you won’t get rich off credit card points, but they can be a nice perk!). Feel free to email me or send me a dm for a referral link to the card we use. Hope that helps:)

Pingback: How to Make a Zero Based Budget (With an Example!) - Megan Makes Sense

Pingback: Here's Exactly What To Do With Your First Paycheck at a New Job - Megan Makes Sense

Pingback: 5 Best Personal Finance Goals for Beginners to Crush This Year - Megan Makes Sense

Pingback: Proof That You Don't Need a 4-Year Degree to Be Successful: An Interview with Katelyn at Hey You Finance - Megan Makes Sense

Pingback: What I Spend in a Week as a 26-Year-Old Debt-Free DINK (2022 Millennial Money Diaries) - Megan Makes Sense

Pingback: How to Pay Off Student Loans Quickly - Megan Makes Sense

Pingback: Debt Snowball vs. Avalanche Method: Which Debt Payoff Plan is Best for You? - Megan Makes Sense

Pingback: How to Track Your Net Worth: What It Is and Why It Matters - Megan Makes Sense

Pingback: How Compound Interest Completely Changed How I Think About Money - Megan Makes Sense