When I graduated college in 2018, I literally had no idea how much student loan debt I was in. I knew I had student loans, but I assumed that my entry-level engineering salary would make it easy-peasy to pay off.

A few months later, I realized that I owed a whopping $56,000. And it would take me over 8 years to pay back at my current rate!

I hated the thought of being in debt until I was 31. It would only hold me back from purchasing a home, getting married, and doing things that I really valued in life.

After learning more about personal finance and budgeting, I decided wanted to be debt-free much sooner than the 8 years I was currently on track for.

Therefore, I set out on a “pay off student loans as quickly as possible” plan.

Maybe you’re in the same boat and want to know how to pay off student loans, too.

It took a total of 31 months to fully pay off my student loans.

You can read my full student loan payoff story in this post: How I Paid off $56,000 of Student Loan Debt in 31 Months.

Paying off debt isn’t easy and requires a lot of discipline, but it is 100% worth it.

If you’re feeling buried under your student loan debt, know that you’re not alone. Over 43 MILLION people have student loans, and the average balance is creeping near $40,000 per person.

The student loan industry is incredibly predatory. It’s important to completely understand your student loan debt and make a plan to pay it off.

Not only will you save a ton of money in interest by paying off your student loans early, but you’ll also free up your monthly cash flow to do other more important things.

Think about what your life would look like with no more student loan payments!

This article will explain why it’s important to take responsibility for your debt and how to pay off student loans quickly.

It is possible to pay them off much sooner than your current timeframe likely calls for!

Should I Pay Off My Student Loans?

If you’re wondering whether you should pay off your student loans or not, the short answer is yes.

Ignoring your student loan debt is the absolute worst thing you can do. Hellooooo financial stress!

Plus, who wants to still be paying off their degree while your own kids are in college or you’re trying to retire?

A study from AARP reports that people are carrying student loan debt for longer periods of time and it’s preventing them from accumulating enough savings to comfortably retire.

And 29% of borrowers between the ages of 50 and 64 are in default.

And don’t get me started on the government promising student loan forgiveness.

I personally believe there will be no shortage of politicians promising to “forgive” your student loan debt.

I also personally believe that they won’t ever do it.

If you’re waiting around for the government to come fix your financial situation, you’re in for a sad life.

There is so much more satisfaction when you take control of your life and are proactive with your finances and goals. Waiting around for someone else to fix your problems is an almost guaranteed way to feel unfulfilled and purposeless.

At the end of the day, you took out a loan. Even as an 18-year-old who didn’t fully understand the terms and conditions (I do feel for those whose parents and high school counselors encouraged massive debt for an education without looking at the ROI and other alternatives).

Plus, the current administration has had over a year to “forgive” student loans. He ain’t gonna do it!

What to do During Student Loan Forbearance

Hopefully you’re on the same page and have decided that paying off your student loans is one of your financial goals.

However, federal student loans are still in a forbearance period (meaning no payments are due and no interest is accruing).

Currently, payments and interest are set to resume in May of this year.

So math-wise, there isn’t a huge incentive to continue making payments while they’re paused at 0% interest.

If this is your situation, here’s what I would do:

1. Use the forbearance period to build an emergency fund if you don’t have one yet, or pay off higher-interest debt. Get yourself in a better financial situation so you’re ready when payments do come back!

2. If you have an emergency fund and no other high-interest debt, focus on piling up cash in a savings account and make a lump-sum payment on your loans once the forbearance period ends. I only recommend this option if you aren’t easily tempted to spend money!

3. Continue making payments like normal and take advantage of the 0% interest period. Every payment made during this period will go straight to principle, which will help you pay off your student loan debt faster. This is a good option if you’re easily tempted to spend money!

How to Pay Off Student Loans Quickly

Here are a few practical tips to help you pay off student loans quickly.

Make a List of All Your Student Loans

The first thing you’ll want to do after deciding to pay off your student loans is figure out where you stand.

How much do you owe and what are the interest rates and minimum payments?

Make a list of each individual loan, the interest rate, and minimum payment. Getting organized will help you make a plan.

If you’ve never added up all of your debt, this might shock you a bit! Just remember that the first step to fixing a problem is understanding where you’re at.

Choose a Debt Payoff Strategy

Once you’ve got a list of all of your student loans, it’s time to choose a debt payoff strategy!

The two most popular ones are the debt snowball and the debt avalanche.

With the debt snowball, you’ll pay off the loan with the smallest balance first. The debt avalanche strategy has you tackle the loan with the largest interest rate first.

You’ll make minimum payments on all of your loans and then throw all of your extra cash at one loan at a time. Once you pay off a loan, roll that minimum payment into the next one until you’re debt free!

I wrote a whole blog post all about the debt snowball vs. the debt avalanche and how to choose the best method for you. Check out that post for a more in-depth explanation of both strategies!

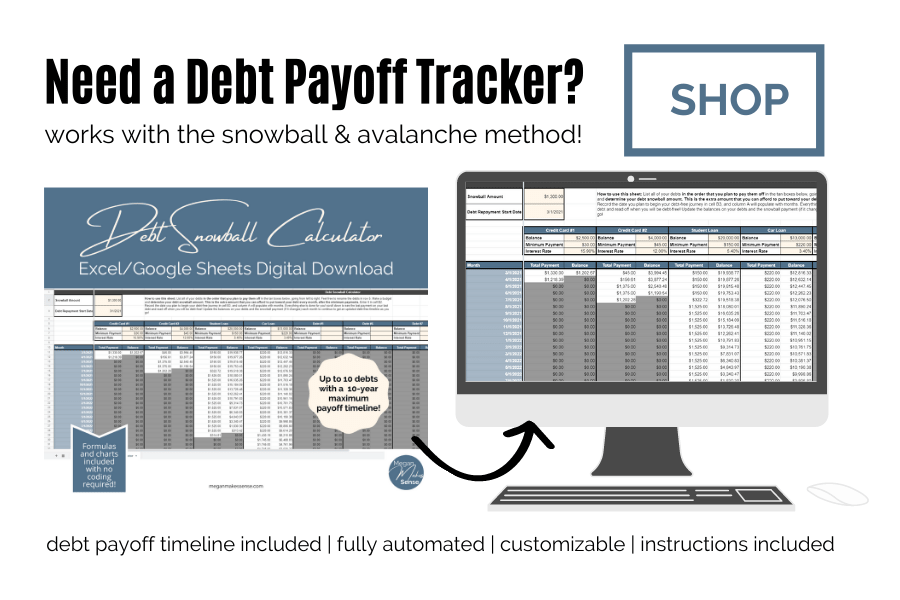

This debt payoff spreadsheet will also help you get organized and hold you accountable to your student loan payoff plan.

Input your loan info in the order you plan to pay them off, an extra “snowball” payment, and the spreadsheet will give you a payoff plan and timeline! And it works with both the snowball and avalanche method.

You’ll get your student loan debt paid off faster by sticking with a strategy and throwing as much money toward your debt as possible.

Pay More Than the Minimum

In order to pay off student loans faster, you HAVE TO PAY MORE THAN THE MINIMUM.

Student loan debt (especially high-interest loans) are designed to keep you in debt for as long as possible, because Sallie Mae makes more money as long as you are in debt.

I’ve even heard horror stories about people making their minimum payments on time, and somehow still end up owing more than they borrowed years later.

Don’t let this be you. Put as much of your income toward your student loans as you can so you can avoid those hefty interest charges.

Any extra payments you make will go directly toward the principle of the loan– which is a good thing!

Every student loan payment is made up of principle (the amount you actually borrowed) and interest (the price you pay for borrowing money).

Interest charges only prevent you from paying down the original balance of your loan.

As you make extra principle payments toward your student loans, the interest charges will start to decrease, meaning that more of your payment will actually go toward principle!

If you’re easily tempted to spend money, try making multiple payments throughout the month. You can’t spend money that you don’t have!

For more motivation, track how much interest you’re paying every month.

You can even find out how much interest accrues each DAY by multiplying the balance of your loan by the interest rate and dividing that number by 365.

If that doesn’t get you fired up to pay off your loans ASAP, I don’t know what will.

You might be surprised at how much those loans are costing you every. single. day.

If you want to pay off student loans fast, you have to pay more than the minimums.

Create a Zero-Based Budget

Creating a monthly budget will help you understand how much income you bring in every month, how much you need to live on, and how much is left over.

I know budgets get such a bad reputation for being restrictive, but they’re not meant to be that way. A budget is simply a plan for your money.

A zero-based budget means that every single dollar that comes in gets allocated (so the money in – money out = 0).

Once you understand your income and expenses, you can figure out how much is left over for extra payments to your student loans.

I love zero-based budgets because every extra dollar has a job. You make a plan for your money and tell it where to go.

No budget = no plan.

And no plan means you’ll have no idea how much extra you can allocate toward your student loans.

And no extra payments means you won’t pay off student loans quickly.

You get the picture.

If you want some help creating a zero-based budget, this monthly budget template is a great place to start.

I use this template to make my budget and track my spending every single month. It’s beginner-friendly, comes with instructions, and includes budget categories to help you get started.

Related: How to Create a Zero Based Budget (And Actually Stick to It!)

Look into Refinancing Your Student Loans

If your student loans are on the higher interest side (5% or higher) and you have decent credit, refinancing might be a good option for you.

Getting another loan provider to take over your loan at a lower interest rate means that more of your payment will go toward the principle of your loan.

More money going toward principle means that you’ll pay off your student loans faster!

And it can save you thousands in interest (literally).

Simply going from 8% to 4% on a $10,000 loan will save you over $2400 in interest alone. If you have high-interest student loans that you can’t pay off in a few months, I highly recommend looking into refinancing.

Nerdwallet has a great article summarizing the best companies to refinance your student loans with here.

Cut Unnecessary Expenses

In order to pay off student loans quickly, you’ll need to trim your budget to find extra cash to put toward them.

I don’t think it’s healthy to cut everything fun out of your budget, but it’s important to be mindful of discretionary spending when you’re in a season of paying off debt.

My biggest tip for trimming your budget is to start with your largest 3 expenses. For most people, that’s housing, food, and transportation.

Getting a roommate can easily save you hundreds per month.

Driving a cheaper, used car can also save you hundreds per month.

Packing your lunch and eating at home more often can also save you hundreds per month.

Cutting out $5 coffee seems pointless if you’re renting a luxury apartment and driving an expensive car. You don’t want to be penny wise and pound foolish!

However, depriving yourself too much can also backfire pretty quickly. You know those people who go on crash diets, lose 20 lbs really fast, and then gain even more weight back?

The same thing can happen with your finances.

So trim your budget, but don’t deprive yourself everything.

And remember that this season is temporary.

You won’t always have to sacrifice a nice vacation to pay off debt.

You won’t always have to rent a cheap apartment with 3 roommates.

But if you ignore your student loan debt and continue accruing more debt, you will always have to sacrifice things that matter because you won’t have the cash flow to sustain them.

There is plenty of time to drive nice cars once your debt is paid off and you’re more established financially!

When I was paying off debt, I continued to drive my high school car (instead of signing up for a $500 car payment), lived with 2 roommates for a year, and packed my lunch for work almost every day.

Doing those 3 things made a huge difference in my budget, and it meant that I still had room for fun as I was paying off student loans.

And if I had to go back in time I would 100% make those same decisions. The small sacrifices were so worth it.

Increase Your Income

Once you’ve got your student loan payoff plan going, are on a solid budget, and have cut out unecessary expenses, it’s time to look into increasing your income.

You can only cut so much out of your budget before you’re completely miserable, but there is no limit to what you can earn.

If you’ve cut everything you can and you still don’t have much left over for extra debt payments, you may need to look into increasing your income.

Finding a new job, picking up a part-time job, or working overtime can really accelerate your debt payoff timeline. Find something that you’re good at and enjoy, and use those skills to make some money!

Or check out this list of easy side hustle ideas to pay off your student loans faster!

Of course, this step is completely optional if you’re comfortable with your current debt payoff timeline, lifestyle, and income.

Put Windfalls Toward Your Student Loan Debt

Getting a bonus this year at work? Large tax refund?

Throw all of that at your student loans!

Large lump-sum payments to your debt can cut months or years off of your payoff timeline.

I learned this first hand after recieving a signing bonus at my first job out of college. You know what I did with that $6000 windfall?

Used it to pay off both of my federal student loans in one lump-sum payment. I was able to eliminate 2 loans with one payment, speeding up my overall payoff timeline by months!

Student loans suck because they rob you of the ability to build wealth.

I cringe when I think about what I could have done with that $6000 if I didn’t have debt (max out a Roth IRA, beef up my emergency fund, save for a car, etc).

As you’re paying off student loans, remember that you’re buying your freedom back. One day you won’t have to make those payments, and you’ll have full control over your money!

Don’t Compare Yourself

Remember a debt payoff journey isn’t a race or a competition.

You’ll always see people that graduated debt-free or paid off their loans faster than you.

Trust me, I know how easy it is to feel resentful and jealous of other’s financial situations.

It would have been nice to graduate debt-free.

But you didn’t. And you’re not alone.

There will always be someone ahead of you (financially or in something else), but it’s irrelevant. All you can do is focus YOUR life and YOUR future.

There’s a reason the windshield is larger than the rearview mirror.

Plus, a debt-free journey teaches you so many lessons in contentment, intentionality, and purpose. I 100% believe that I wouldn’t be where I am financially if I didn’t have that “oh crap” moment with my student loan debt 3 years ago.

In a way, I’m actually thankful for my student loan journey because it inspired me to create this blog and help others!

We’re all on our own timelines, and that’s okay.

Focus on what you can control, and keep plugging along on your journey.

You got this!

Are you working on paying off student loans? Let me know how it’s going in the comments below or on Instagram!

-Megan

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: Proof That You Don't Need a 4-Year Degree to Be Successful: An Interview with Katelyn at Hey You Finance - Megan Makes Sense