Deciding to pay off your debt once and for all is no easy task. It takes discipline, sacrifice, and a clear debt payoff plan to make those extra payments so that you can live debt-free in the future.

The first question you may be asking yourself is which debt payoff strategy is best: the debt snowball vs. the avalanche method?

The snowball and avalanche method are similar in execution, but the strategy behind each plan is a bit different.

If you’re wondering which debt payoff method is the best, the answer is that it depends!

Some people might really benefit from the small wins using the debt snowball method, and others might be more motivated to save the most money in interest and choose the debt avalanche method.

At the end of the day, choosing either the debt snowball vs. avalanche method doesn’t really matter.

As long as you’re making extra payments to your current “focus debt” and your overall debt is decreasing, you’re well on your way to living the debt-free life!

Trust me, I graduated college with $56,000 in student loan debt and I have been able to pay it off in 2.5 years. Being in debt sucks, but making the choice to live debt-free has been so rewarding and totally worth it!

This post is all about the similarities and differences between the debt snowball vs. avalanche method and how to choose the right debt payoff plan for you.

The Debt Snowball vs. Avalanche Method

Both the debt snowball and avalanche strategies have you focus on one debt at a time.

You’ll throw all your extra cash at one loan while making minimum payments on the other debts. Make sure you’re still making all the minimum payments throughout this process!

As you pay off each debt, you roll that payment into the next “focus debt,” pay that one off, and roll that former payment into the next one until you’ve paid off all your debts!

Keeping your main focus on one debt at a time will help keep you motivated during your debt-free journey.

Let’s talk a little bit more about the specifics behind the debt snowball vs. the debt avalanche methods.

What is the Debt Snowball Method?

The debt snowball method has been made popular by personal finance guru, Dave Ramsey. It has almost a cult-like following that people swear by, with no regard for other situations or opinions.

Be wary of “experts” telling you that there is a one-size fits all solution to any problem!

However, the debt snowball is still a solid debt repayment plan option. Here is the debt snowball process:

- List all of your debts from smallest balance to largest balance

- Throw all of your extra money at the smallest debt first, while making minimum payments on the others

- After you pay off the smallest debt, roll that former payment into the next smallest debt

- Continue the “snowball” until all of your debts are paid off!

The major criticism of the debt snowball method is that it doesn’t take interest rates into account.

Starting with the smallest debt means it will take less time to completely pay off that first debt than if you had started with a larger debt.

Therefore, the snowball method is great for quick wins and motivation to keep going because you’ll see progress faster.

The downside to the debt snowball is that it may not be the most efficient way to pay off debt when you’re looking at total interest paid and the time period to debt freedom.

You’ll pay a little more in interest over a slightly longer period of time with the debt snowball vs. avalanche method.

But, the snowball method could also keep you motivated to keep going on your debt free journey if you’re someone who needs to see progress faster.

Related: 5 Ways I Don’t Follow the Dave Ramsey Method (and Why You Shouldn’t Either)

What is the Debt Avalanche Method?

The debt avalanche method follows the same process as the snowball method, except that you order your debts from largest to smallest interest rate. Here’s the debt avalanche process:

- List your debts from largest to smallest interest rate

- Throw all of your extra money at the debt with the highest interest rate first, while paying the minimums on the other loans

- After you pay off the highest interest rate loan, roll that former payment into the loan with the next highest interest rate

- Continue the “avalanche” until all of your debts are paid off

If we were only looking at math, the debt avalanche would win every time.

By focusing on the highest interest rate debt first, you’ll pay less in interest vs. the snowball method. You’ll also become debt-free a bit sooner.

The potential downside to the debt avalanche method is actually following through on your strategy because it might take longer to see progress.

It can be especially tricky if your highest interest rate debt is also the one with the largest balance.

If you focus on the largest debt first, you’ll have less money for your extra “avalanche” payments at the beginning since you still have to make the minimum payments on your other debts as well.

With the snowball method, the largest debt comes last after you’ve freed up your income a bit more by paying off your smaller debts first.

With the snowball method, you’ll end up spending less time paying off the largest individual debt, but your total timeline to become debt-free will be a bit longer compared to using the avalanche method.

Overall, it will take you more time to pay off your largest debt with the avalanche method vs. the snowball, but you’ll also pay off your total debt faster.

Progress can start out slow with the avalanche method, but goes much faster once you get the high-interest debts gone.

So Which Debt Payoff Plan is Better?

So why doesn’t everyone use the debt avalanche strategy if you pay less in interest and become debt-free faster? This is the question I asked myself after I learned about both methods!

As much as I’d love to believe that money is just spreadsheets and math, the truth is that money is emotional.

Everyone knows that they should make less frivolous purchases, save money for emergencies, and contribute to their retirement accounts. Then why do 78% of Americans live paycheck to paycheck, and only 40% can cover an unexpected $400 expense?

We all know that you need to eat less junk food and exercise in order to maintain a healthy weight. Then why are two-thirds of American adults overweight?

I totally believe that personal finance (and pretty much anything, really) is just 20% knowledge and 80% behavior. It’s simple stuff, but actually having the discipline to follow through with your actions is the difficult part.

There isn’t a clear “right” answer on if you should use the debt snowball vs. the avalanche method.

You can decide which one makes sense for your financial situation and motivations, but the important thing is to actually follow through on making those extra payments.

I’ll walk you through an example to show you why the strategy is less important than the follow through.

How to Create a Debt Payoff Plan – A Step By Step Example

Let’s say someone has the following 4 debts:

- Credit Card: $4000 at 18% interest with a $40 minimum payment

- Student Loan A: $7,000 at 3.5% interest with an $80 minimum payment

- Student Loan B: $10,000 at 6.5% interest with a $100 minimum payment

- Car Loan: $13,000 at 4.5% interest with a $242 minimum payment

Let’s also assume that this person made a budget and has an extra $1000 each month (after accounting for the minimum payments) for extra payments toward her debt.

How to Use the Snowball Method

Here’s what her debt payoff plan would look like using the snowball method:

She would pay off the debts with the smallest balance first, so the order would be credit card, student loan A, student loan B, and then the car loan.

Using the debt snowball, she would become debt-free in 25 months and have paid $1972.89 in total interest.

How to Use the Avalanche Method

Here’s what her debt payoff plan would look like using the avalanche method:

She would order her debts from largest to smallest interest rate. The payoff order would then be credit card, student loan B, car loan, then student loan A.

Using the debt avalanche strategy, she would still become debt-free in the same 25 months! However, her overall interest paid is $1791.51, a couple hundred dollars less than the snowball method.

A couple hundred dollars over the course of 2 years isn’t a big deal.

As you can see, it doesn’t really matter which debt payoff method you use.

The only way that you’ll become debt-free is to find room in your budget for those extra payments and actually make them each month.

You have to pay more than the minimums if you want to get out of debt.

Having a debt repayment strategy (aka, snowball vs. avalanche) will help you optimize those extra payments so you can pay less in interest and get out of debt faster.

The order in which you pay off debts is less important than just picking one at a time and throwing all your extra money at it until it’s paid off.

You Might Choose the Debt Snowball If…

- You’re motivated by quick wins.

- Your debts have similar balances and/or interest rates.

- You have a lot of small debts.

You Might Choose the Debt Avalanche If…

- You’re motivated by paying the least amount of interest possible.

- You can see the big picture and have the discipline to follow through when you don’t see immediate progress.

- Your highest interest debt is also one of the smaller ones.

- You have a high credit card balance and want to save money on interest by paying that off first.

So you’ve learned everything you need to know about the debt snowball vs. the avalanche method and you’ve picked the right debt payoff strategy for your situation.

That’s the easy part!

Now you might be wondering, “How do I put this into practice and actually make progress on my debt-free journey?”

The Real Secret to Paying Off Debt (That No One Talks About!)

The absolute first step to paying off any amount of debt is to actually believe that you can.

If you can’t visualize yourself living debt-free, making those extra payments, and sacrificing a few things in the short-term, you’ll never do it.

So check those limiting beliefs at the door.

Stop telling yourself that “I’ll always have a car payment,” “everyone else has student loans,” or “I’ll always be in debt because no one taught me about money!”

Yes, everyone else has debt and complains that they didn’t learn personal finance in school.

But guess what?

If you keep complaining that you never learned this stuff instead of actually taking action to learn and improve, you’ll be in the same position 10 years from now.

You can decide to live differently that most people and learn personal finance on your own.

Your life will probably look different that most of your friends’ right now, and that’s okay!

So believe that you can pay off your student loans, car loan, or credit card debt.

Be ready to do whatever it takes to pay off your debt because the vision of a debt-free future is so clear to you and nothing will stop you from achieving it.

Bonus Debt Payoff Tips

- Understand WHY you want to get out of debt. You need a clear purpose to stay disciplined.

- List out each debt with the balances, interest rates, and minimum payments to stay organized. (Hint: sign up for my email list to get a free financial game plan that will help you get started!)

- Choose your strategy and stick with it.

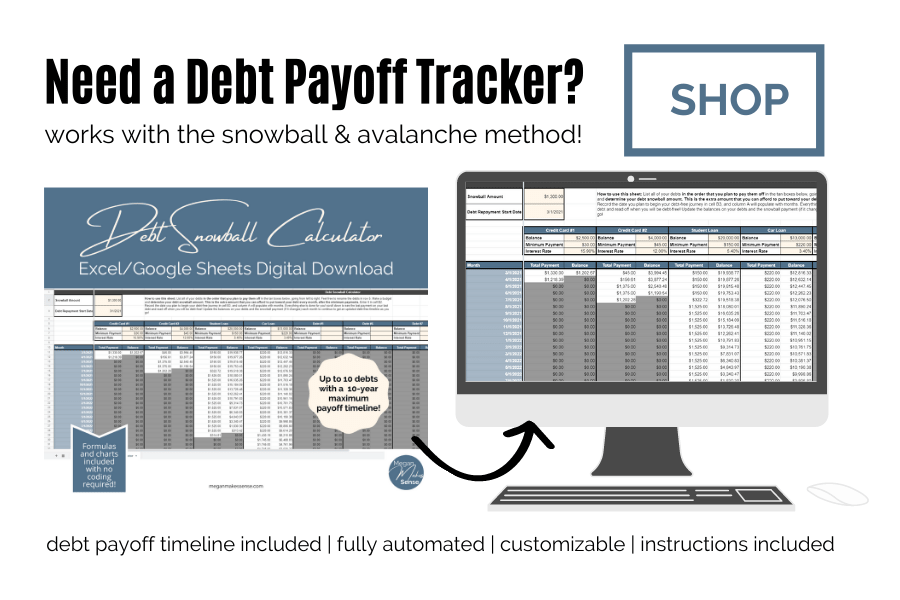

- Track your progress! Download some debt payoff tracker charts and hang them somewhere where you can see!

- Create a household budget to figure out how much extra money you can put toward your debt snowball or avalanche payment.

- Execute on your plan and make adjustments as you go. Don’t expect every month to be perfect!

- Find creative ways to increase your income and decrease your expenses.

I believe in you! Keep working your financial plan, making adjustments as you go, and tracking your progress.

You WILL get there!

There is seriously no better feeling than not owing anyone a dime.

Paying off your debt is a challenge, but it is so worth it!

If you’re serious about your debt payoff journey, grab this Debt Snowball Calculator to help you create an actionable, organized, debt payoff plan in minutes!

Did this post help you map out a strategy for paying off your debt? Let me know in the comments below!

I’d love to hear from you!

-Megan

Read next: 3 Actionable Personal Finance Rules to Help You Live Below Your Means

Megan is an automotive engineer, newlywed, and personal finance blogger from the midwest. She found her passion for personal finance after starting her first “real job” after graduating college. Now, she helps other young professionals become more intentional with their money in order to build wealth for financial freedom. In her free time, she loves to travel, hike, and play euchre with her family. Read more about her story here.

Pingback: 10 Warning Signs That You Are Living Beyond Your Means - Megan Makes Sense

Pingback: How to Save Your First $100k - Megan Makes Sense

Pingback: 5 Credit Score Myths That are Keeping You Broke - Megan Makes Sense

Pingback: How to Set Financial Goals for the New Year in 6 Easy Steps - Megan Makes Sense

Pingback: 6 Smart Things to Do With Your Tax Refund This Year - Megan Makes Sense

Pingback: The Complete Beginner's Guide to Saving for Retirement - Megan Makes Sense

Pingback: The Ultimate List of Investing Terms Every Beginner Investor Needs to Know - Megan Makes Sense

Pingback: 5 Signs You're Ready to Start Investing - Megan Makes Sense